capitolovo.ru

Market

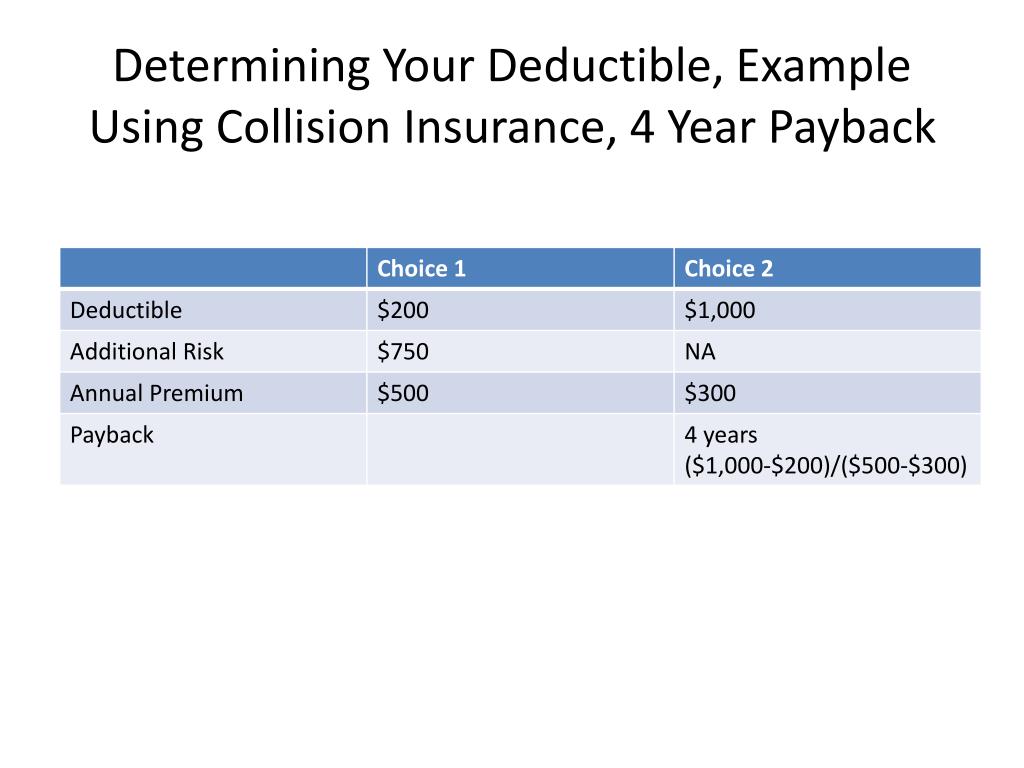

Do I Need Collision Deductible

Do I really need collision insurance?” While collision insurance isn't required by state law, it's always a smart option – with so much on the road that you can. What does collision insurance cover? Collision coverage may extend beyond your own vehicle, regardless of who causes the accident. It includes. Collision insurance helps pay to repair or replace your car if it's damaged in a collision with another vehicle or object. Learn about coverage, deductibles. Collision is often required as a condition for a loan or a lease agreement. However, if you own the vehicle outright, this coverage is optional. What does. However, if you're at-fault for an accident, there's not much you can do to get out of your collision insurance deductible if you want your own vehicle repairs. Collision coverage will help protect you and your vehicle if you were to get into an accident with another vehicle or object, or a hit and run by a third party. Some coverages are required if you finance or lease your car but not if it's paid off. Learn when to drop collision coverage and other optional coverages. No matter how old your car is, you need collision insurance if you have an auto loan or lease. But what if you're not leasing your vehicle, and your loan. Do I need collision coverage? Collision insurance isn't required by law. Lenders may require collision coverage if your car is being financed or leased, but. Do I really need collision insurance?” While collision insurance isn't required by state law, it's always a smart option – with so much on the road that you can. What does collision insurance cover? Collision coverage may extend beyond your own vehicle, regardless of who causes the accident. It includes. Collision insurance helps pay to repair or replace your car if it's damaged in a collision with another vehicle or object. Learn about coverage, deductibles. Collision is often required as a condition for a loan or a lease agreement. However, if you own the vehicle outright, this coverage is optional. What does. However, if you're at-fault for an accident, there's not much you can do to get out of your collision insurance deductible if you want your own vehicle repairs. Collision coverage will help protect you and your vehicle if you were to get into an accident with another vehicle or object, or a hit and run by a third party. Some coverages are required if you finance or lease your car but not if it's paid off. Learn when to drop collision coverage and other optional coverages. No matter how old your car is, you need collision insurance if you have an auto loan or lease. But what if you're not leasing your vehicle, and your loan. Do I need collision coverage? Collision insurance isn't required by law. Lenders may require collision coverage if your car is being financed or leased, but.

If the car is financed through a bank, collision and comprehensive coverage will likely be required. Important information to consider before, during and after. Do I Need Collision Insurance? Although collision insurance is not required by any state, your lending institution may require it if you are financing your. Does my deductible affect this coverage? Yes. The deductible amount you choose for comprehensive and/or collision coverage will affect the amount of payment. Collision coverage protects against damage that occurs in a collision with another vehicle or object. This includes helping to pay for the cost of repairing. In most cases, if you're in an accident where another driver hits your car and causes damage, you won't have to pay your car insurance deductible. In this case. Do I need collision insurance? It depends. Unlike liability coverage, collision insurance is not required by law. That means that you can choose not to have. What else should I consider when choosing my collision deductible? · How much your car is worth · How much coverage you want · How much risk you're comfortable. Otherwise, Collision coverage is not required. However, without Collision insurance, if you damage your vehicle in an accident, you'll be paying for vehicle. If it is, then comprehensive and collision coverage might not be a cost-effective option for you. In other words, you might want to talk to your insurer about. You'll pay the first $ in damage, normally directly to the body shop, and then your insurance will pay the remaining $ Who needs collision coverage? If someone hits my car and I'm not at fault, do I have to pay a deductible? In most cases, if you're in an accident where another driver hits your car and. These waivers are specifically designed for situations when you need to make a claim after an accident with an uninsured driver. Though optional, integrating a. These waivers are specifically designed for situations when you need to make a claim after an accident with an uninsured driver. Though optional, integrating a. Collision is often required as a condition for a loan or a lease agreement. However, if you own the vehicle outright, this coverage is optional. What does. If you're leasing or financing your car, collision coverage is typically required by the lender. If your car is paid off, collision is an optional coverage on. What does collision insurance cover? Collision coverage may extend beyond your own vehicle, regardless of who causes the accident. It includes. Otherwise, Collision coverage is not required. However, without Collision insurance, if you damage your vehicle in an accident, you'll be paying for vehicle. Do I need collision coverage? Collision insurance isn't required by law. Lenders may require collision coverage if your car is being financed or leased, but. Do I Need Collision Insurance? You need collision insurance if your car is not fully paid off and your lender or lessor requires it. If you fail to purchase.

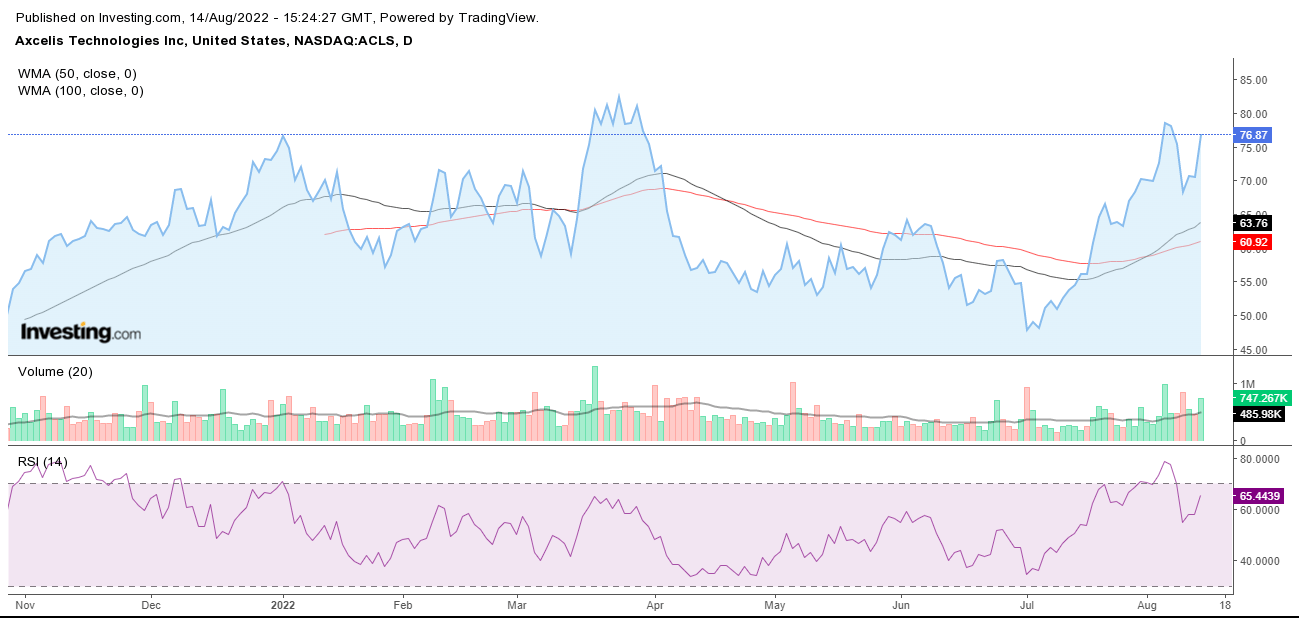

Axcelis Technologies Stock Forecast

According to the research reports of 7 Wall Street equities research analysts, the average twelve-month stock price forecast for Axcelis Technologies is $ Based on analysts offering 12 month price targets for ACLS in the last 3 months. The average price target is $ with a high estimate of $ and a low. The forecasts range from a low of $ to a high of $ The average price target represents an increase of % from the last closing price of $ The average stock forecast for Axcelis Technologies Inc (ACLS) is USD. This price target corresponds to an upside of %. 13 analysts offering month price forecasts for Axcelis Technologies Inc (ACLS) have a share price target of $ This median of share price forecast. Axcelis Technologies (ACLS) stock price prediction is USD. The Axcelis Technologies stock forecast is USD for September. Axcelis Technologies stock prediction for 1 year from now: $ (%) · Axcelis Technologies stock forecast for $ (%) · Axcelis. Axcelis Technologies, Inc. engages in the manufacture of capital equipment for the semiconductor chip manufacturing industry. EarningsAxcelis posted net income of $ per diluted share, surpassing investor expectations by $, with sales exceeding expectations by $ million. According to the research reports of 7 Wall Street equities research analysts, the average twelve-month stock price forecast for Axcelis Technologies is $ Based on analysts offering 12 month price targets for ACLS in the last 3 months. The average price target is $ with a high estimate of $ and a low. The forecasts range from a low of $ to a high of $ The average price target represents an increase of % from the last closing price of $ The average stock forecast for Axcelis Technologies Inc (ACLS) is USD. This price target corresponds to an upside of %. 13 analysts offering month price forecasts for Axcelis Technologies Inc (ACLS) have a share price target of $ This median of share price forecast. Axcelis Technologies (ACLS) stock price prediction is USD. The Axcelis Technologies stock forecast is USD for September. Axcelis Technologies stock prediction for 1 year from now: $ (%) · Axcelis Technologies stock forecast for $ (%) · Axcelis. Axcelis Technologies, Inc. engages in the manufacture of capital equipment for the semiconductor chip manufacturing industry. EarningsAxcelis posted net income of $ per diluted share, surpassing investor expectations by $, with sales exceeding expectations by $ million.

Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. ACLS will report Axcelis Technologies is forecast to grow earnings and revenue by % and % per annum respectively while EPS is expected to grow by % per annum. Over the last 12 months, its price fell by percent. Looking ahead, we forecast Axcelis Technologies to be priced at by the end of this quarter and. Our Axcelis Technologies Inc stock forecast data is based on consensus analyst prediction, covering public companies earnings per share and revenue. Axcelis Technologies stock price target raised to $45 from $38 at Benchmark. Feb. 12, at a.m. ET by Tomi Kilgore. Axcelis Technologies Stock Forecast, ACLS stock price prediction. Price target in 14 days: USD. The best long-term & short-term Axcelis Technologies. Axcelis Technologies holds several negative signals and is within a very wide and falling trend, so we believe it will still perform weakly in the next couple. View Axcelis Technologies, Inc. ACLS stock quote prices, financial information, real-time forecasts, and company news from CNN. Axcelis Technologies Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Axcelis Technologies (ACLS) Q2 Earnings and Revenues Beat Estimates. Axcelis (ACLS) delivered earnings and revenue surprises of % and %, respectively. Investors have an opportunity to buy Axcelis Technologies stock at an incredible price, ahead of the company's return to growth in The average of price targets set by Wall Street analysts indicates a potential upside of % in Axcelis (ACLS). While the effectiveness of this highly sought-. On average, Wall Street analysts predict that Axcelis Technologies's share price could reach $ by Aug 2, The average Axcelis Technologies stock. The current price of ACLS is USD — it has increased by % in the past 24 hours. Watch Axcelis Technologies, Inc. stock price performance more closely. Axcelis Technologies, Inc. designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips. The current Axcelis Technologies [ACLS] share price is $ The Score for ACLS is 37, which is 26% below its historic median score of 50, and infers higher. Exchange. NASDAQ-GS ; Sector. Technology ; Industry. Industrial Machinery/Components ; 1 Year Target. $ ; Today's High/Low. $/$ Stock Price Forecast. The 5 analysts with month price forecasts for ACLS stock have an average target of , with a low estimate of and a high. Axcelis Technologies has a consensus price target of $ Q. What is the current price for Axcelis Technologies (ACLS)?. A. The stock. Based on ratings from 5 stock analysts, the Axcelis Technologies Inc stock price is expected to increase by % in 12 months. This is calculated by using the.

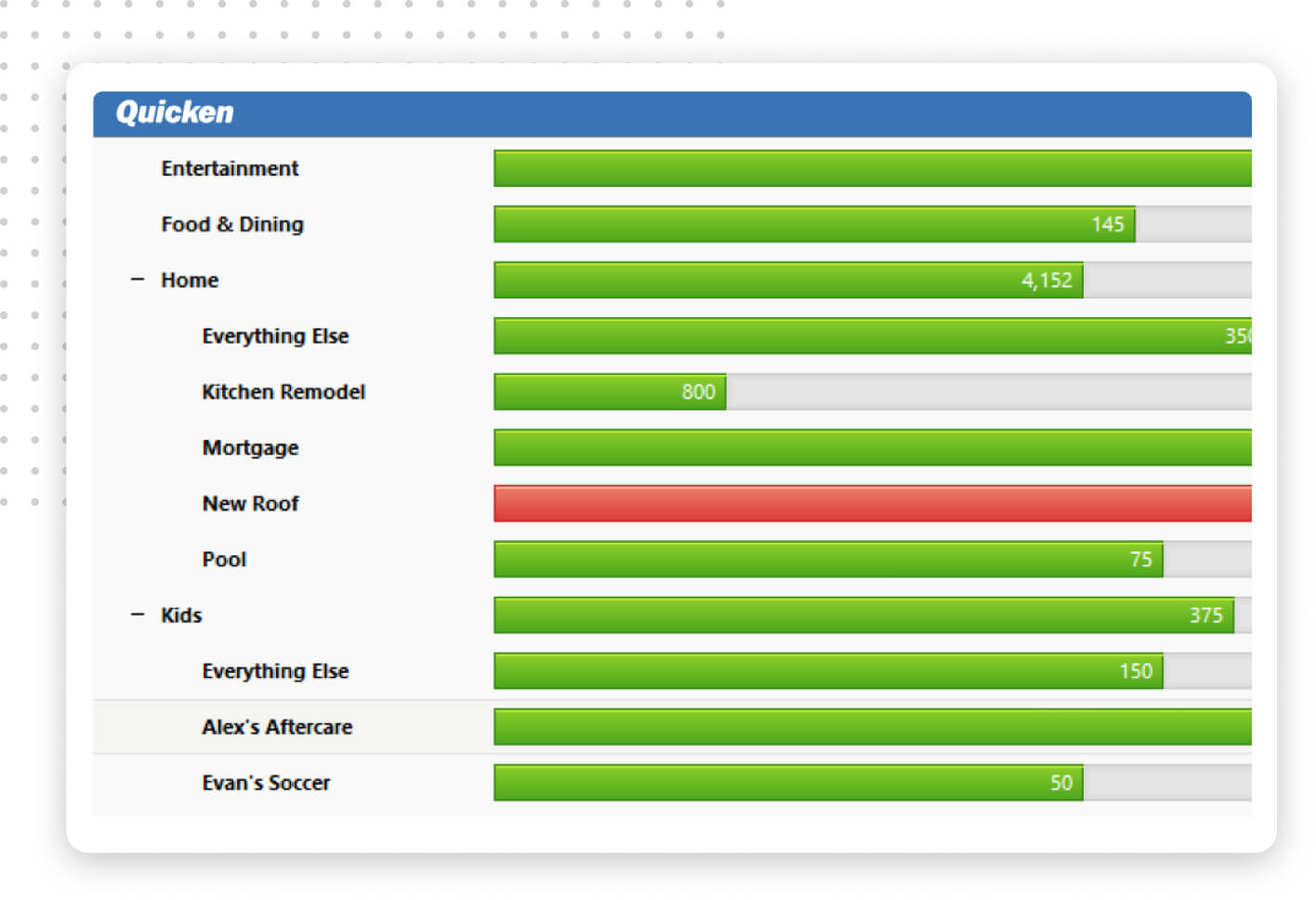

Intuit Home Budget

Free personal finance software to assist you to manage your money, financial planning, and budget planning tools. Achieve your financial goals with Mint. Yes, Mint's parent company, Intuit, uses advanced security and technology to protect its clients' personal and financial information. Security methods. Go to Settings · Select Create budget. · Ensure the Budget type is set. · From the Period dropdown ▽, select the fiscal year you're creating the budget for. The Best Accounting Deals This Week* · Intuit QuickBooks Online — Save 50% Off Quickbooks Online for 3-Months · Xero — Save 75% Off Xero Business Edition Plans. QuickBooks home accounting software helps you: Track expenses & stay on budget; Manage rental income and taxes. Start now for free. Mint aficionados need not despair because Intuit shuttered the popular free money management app on March 23, money, personal finance, personal budgets. Go to Settings ⚙ then select Budgeting. · Select Create new. · Select Budget type: Balance sheet. · Select the fiscal year you're creating the budget for. · Select. QuickBooks and Quicken are financial management tools owned by Intuit finances in a single place by helping them manage their budget and control expenses. Experience a fresh way to manage money with Mint budgeting app. Reach your financial goals with personalized insights and custom budgets. Free personal finance software to assist you to manage your money, financial planning, and budget planning tools. Achieve your financial goals with Mint. Yes, Mint's parent company, Intuit, uses advanced security and technology to protect its clients' personal and financial information. Security methods. Go to Settings · Select Create budget. · Ensure the Budget type is set. · From the Period dropdown ▽, select the fiscal year you're creating the budget for. The Best Accounting Deals This Week* · Intuit QuickBooks Online — Save 50% Off Quickbooks Online for 3-Months · Xero — Save 75% Off Xero Business Edition Plans. QuickBooks home accounting software helps you: Track expenses & stay on budget; Manage rental income and taxes. Start now for free. Mint aficionados need not despair because Intuit shuttered the popular free money management app on March 23, money, personal finance, personal budgets. Go to Settings ⚙ then select Budgeting. · Select Create new. · Select Budget type: Balance sheet. · Select the fiscal year you're creating the budget for. · Select. QuickBooks and Quicken are financial management tools owned by Intuit finances in a single place by helping them manage their budget and control expenses. Experience a fresh way to manage money with Mint budgeting app. Reach your financial goals with personalized insights and custom budgets.

Create budgets in QuickBooks Online. by QuickBooks• • Updated June 14, Enter and manage expenses in QuickBooks Online Intuit, QuickBooks, QB. Empower your students through personal finance education. The Intuit for Education Personal Finance curriculum teaches students about taxes, credit, investing. Download apps by Intuit Inc., including QuickBooks Time Kiosk, IntuitCommutes, QuickBooks Money, and many more Home app · Apple Music · Siri · AirPlay. > Budgeting: Income & Expenses. > Evaluating Credit Card Offers. > Analyzing a Credit Report & Score. Intuit Education: Mint Answer Key. Page 2. Education. Create a customized budget; Manage and track your debt; Create savings goals; Simplify your taxes and track investments. Take charge of your finances with Mint's online budget planner. Our free budget tracker helps you understand your spending for a brighter financial future. Home · personal finance · How-to-save-money. Six of the Best Budgeting Apps Intuit, the company that owns Mint, is encouraging users to migrate to. Get the comprehensive financial planning tool to manage expenses, investments, budgets & more. Quicken is trusted by millions for more than 30 years. Home · personal finance · How-to-save-money. Six of the Best Budgeting Apps Intuit, the company that owns Mint, is encouraging users to migrate to. Intuit, and protect your family's finances. Expand · (k) Retirement Plan Discover financial coaching and solutions from balancing your budget to advanced. Quicken can help you stay on top of your budget, make smart decisions with your money, save towards your goals, and plan your retirement. There are a few things outside the app functionality itself that users should consider before deciding on a budgeting app and this is why. Mint shuts down 2. The Best Accounting Deals This Week* · Intuit QuickBooks Online — Save 50% Off Quickbooks Online for 3-Months · Xero — Save 75% Off Xero Business Edition Plans. Get the comprehensive financial planning tool to manage expenses, investments, budgets & more. Quicken is trusted by millions for more than 30 years. Intuit Ecosystem of Financial Products. Products for consumers, small Home Loans · QuickBooks Self-Employed. For Small Business. QuickBooks · Accounting. Mint aficionados need not despair because Intuit shuttered the popular free money management app on March 23, money, personal finance, personal budgets. How Much Does It Cost to Attend the World Series? Income and Investments. How to Set Realistic Financial Goals. Family. Fall Family Activities That Fit In Any. +MoreAll Personal FinanceBest Budgeting AppsBest Expense Tracker AppsBest Money A Intuit Survey of at least 1, people found that more than by Intuit• Updated 1 year ago. Learn how to use your data to create budgets and forecasts. QuickBooks Desktop has budgeting and forecasting tools to help you. Intuit is shutting down its free budgeting app Mint, which had million active users in , Bloomberg reported. The company will absorb users into its.

Who Offers Free Checking Near Me

Plains Commerce Bank believes that your free checking account should be just that—free. Open an account with no monthly service fees, minimum balance, or. If you convert from a Wells Fargo account with check writing ability to a Some (but not all) digital wallets require your device to be NFC (Near Field. With no minimum balances and no monthly fees, Eastern Free Checking lets you bank anytime. anywhere, and hassle-free. Branch Locator · Site Map · About Our Ads · Site Requirements · Security & Legal Our Student Checking account does not come with standard overdraft coverage. Close. Search. Site Search. Search Submit. Home · Resources · Money Matters Blogs Some banks and credit unions will offer “free” checking to garner new. Our Unified Checking Account is a truly free* account packed with features that make banking easier and more rewarding. A checking account that's free to open and free to maintain. With Asterisk-Free Checking, there's no cost to open and no monthly maintenance fees. If you're looking for a free checking account near me, most financial institutions don't offer them anymore. Arsenal has been fighting fee frustration with. With a free checking account at Commerce Bank pay no monthly service fees, get free mobile banking and no monthly minimum balance. Open an account online. Plains Commerce Bank believes that your free checking account should be just that—free. Open an account with no monthly service fees, minimum balance, or. If you convert from a Wells Fargo account with check writing ability to a Some (but not all) digital wallets require your device to be NFC (Near Field. With no minimum balances and no monthly fees, Eastern Free Checking lets you bank anytime. anywhere, and hassle-free. Branch Locator · Site Map · About Our Ads · Site Requirements · Security & Legal Our Student Checking account does not come with standard overdraft coverage. Close. Search. Site Search. Search Submit. Home · Resources · Money Matters Blogs Some banks and credit unions will offer “free” checking to garner new. Our Unified Checking Account is a truly free* account packed with features that make banking easier and more rewarding. A checking account that's free to open and free to maintain. With Asterisk-Free Checking, there's no cost to open and no monthly maintenance fees. If you're looking for a free checking account near me, most financial institutions don't offer them anymore. Arsenal has been fighting fee frustration with. With a free checking account at Commerce Bank pay no monthly service fees, get free mobile banking and no monthly minimum balance. Open an account online.

With a Free Checking account, you'll receive many cost-saving advantages, including no minimum balance to maintain and unlimited debit card use, without losing. Convenient banking with Desert Financial's Free Checking account: no monthly Tell me more. What members are saying. "Sophia's attitude and. Our Free Checking Account offers a hassle-free banking experience with no minimum balance requirements and no monthly maintenance fees. Mountain West Bank offers the balance of large bank services with the personal service of a community bank. Business loans, free checking, home loans. Open a Checking account from Capital One, a fee free online checking account that offers interest with no minimums and no-fee checking. Open a PNC checking account online in minutes and get access to our leading mobile banking platform, ~ branches and more than surcharge-free ATMs. Select an option below to open a checking account with: piggy bank Credit Union Near Me No Matter Where I Am. When you are looking for a credit. With several personal online checking accounts, we have fast, simple, and hassle-free banking options for all Nevadans. Open a checking account online. These great features come with every checking account: · Free debit card · Nationwide ATMs · No-fee withdrawals · Online access · Digital wallets · Mobile banking. Choose the best account for you and enjoy Online Banking, Mobile Banking Footnote[1], a debit card with Total Security Protection ® - and much more. Checking built around you. · No minimum balance requirement · No monthly service charge · No charge per check · FREE first order of paper checks. × Close Search. Search Input Search This Site. Login Login. ×. Online Our Free Checking account offers you the convenience of mobile banking and. Capital One does not charge overdraft fees. Best for: Branches and online combination; Branches: Around ; Mobile app offered: Yes; ATM access: More than. Open a Free Checking w eStatements account, Teen checking or High-Yield checking account with SDCCU and experience better banking. Apply online today. The free checking account from Rockland Federal Credit Union in MA provides list of fee-free financial tools and digital services. Open an account today. "Signed up for a checking account, they gave me $ for setting up online banking, eStatements, and making five debit transactions within first 30 days. Open a truly free checking account with FCU today. We've listed the features of each account below so you can choose the account that best fits your needs. If you convert from a Wells Fargo account with check writing ability to a Some (but not all) digital wallets require your device to be NFC (Near Field. Chat with an online representative. Start Chat. Contact Us. Use our secure form to contact us. Contact Us. Branch Locator. Locate a branch near you. Find A. Our free checking account comes with all the basics, plus some attractive extras. Without paying a penny, you'll enjoy free ATM withdrawals at any BancFirst.

Bollinger Bands Explained

The Bollinger Squeeze occurs when the bands come close together, indicating a period of low volatility. This tight constriction is called the “squeeze.” The. What Are Bollinger Bands? Bollinger Bands are a popular indicator that traders use to help determine overbought and oversold levels. Many traders also like. Bollinger Bands are a widely used technical analysis tool traders and investors use to gauge market volatility, identify potential trends, and generate trading. 1. Bollinger Bands provide a relative definition of high and low. By definition price is high at the upper band and low at the lower band. There are three important lines on this chart, and together they make up the Bollinger bands: the middle band is the day moving average of bitcoin's price . The Bollinger Bands indicator is an oscillator meaning that it operates between or within a set range of numbers or parameters. As previously mentioned, the. Bollinger Bands can be used to determine how strongly an asset is rising and when it is potentially reversing or losing strength. If an uptrend is strong enough. What Are Bollinger Bands? Bollinger Bands are a technical analysis tool that traders use to predict when there may be a buying or selling opportunity for a. Bollinger Bands are a technical analysis tool, specifically they are a type of trading band or envelope. Trading bands and envelopes serve the same purpose. The Bollinger Squeeze occurs when the bands come close together, indicating a period of low volatility. This tight constriction is called the “squeeze.” The. What Are Bollinger Bands? Bollinger Bands are a popular indicator that traders use to help determine overbought and oversold levels. Many traders also like. Bollinger Bands are a widely used technical analysis tool traders and investors use to gauge market volatility, identify potential trends, and generate trading. 1. Bollinger Bands provide a relative definition of high and low. By definition price is high at the upper band and low at the lower band. There are three important lines on this chart, and together they make up the Bollinger bands: the middle band is the day moving average of bitcoin's price . The Bollinger Bands indicator is an oscillator meaning that it operates between or within a set range of numbers or parameters. As previously mentioned, the. Bollinger Bands can be used to determine how strongly an asset is rising and when it is potentially reversing or losing strength. If an uptrend is strong enough. What Are Bollinger Bands? Bollinger Bands are a technical analysis tool that traders use to predict when there may be a buying or selling opportunity for a. Bollinger Bands are a technical analysis tool, specifically they are a type of trading band or envelope. Trading bands and envelopes serve the same purpose.

Bollinger Bands are a very popular tool within the field of technical analysis. They were designed by John Bollinger in the early s. The Bollinger Bands, or BB bands, help to see if a market is oversold or overbought and help traders with analyzing if a market is trending or in a range. Bollinger Bands appear as an overlay on a chart and are plotted a number of standard deviations above and below a moving average. Bollinger Bands are a popular technical analysis tool that indicates whether an instrument's price is high or low on a relative basis. Bollinger Bands are a popular technical analysis tool used by stock market traders to assess price volatility and identify potential buy or sell signals. Bollinger Bands, invented by John Bollinger in the s, help traders decide when to trade and spot overbought or oversold stocks. Bollinger Bands are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic. Bollinger Bands are tools used in technical analysis to determine if a particular stock is overbought, oversold, or fairly valued. Bollinger Bands are a technical anaylsis indicator that can be used to determine whether an instrument is overbought or oversold within the financial markets. Bollinger bands are a widely used technical analysis tool that can aid traders in identifying the range by showing the upper and lower bounds of price action. Bollinger Bands are a technical indicator or technical study added to stock charts to visualize price ranges. Invented by John Bollinger in the s, Bollinger Bands are widely used by traders to identify potential price trends and reversals. Bollinger Bands are a technical indicator used to determine the evolving levels of pricing volatility present in the market of a security. Bollinger Bands are an “all-in-one” trading indicator because they can tell you a few things about an investment. Bollinger bands make visualizing a mean reversion trade simple. Using the statistical concept of the normal distribution, the bands allow you to quickly assess. Bollinger Bands are a technical indicator used to determine the evolving levels of pricing volatility present in the market of a security. Bollinger Bands is a useful technical tool in a trader's arsenal and refers to price channels placed on a chart to represent a volatility range of an asset's. Bollinger Bands are envelopes plotted at a standard deviation level above and below a simple moving average of the price. The distance of the bands is based on. Bollinger Bands are an “all-in-one” trading indicator because they can tell you a few things about an investment.

Event Rental Systems Pricing

In addition to the monthly subscription fee (see our pricing page for a listing of monthly fees), there is an annual fee of $99 to host your website. Note, even. Event Rental Systems is a web-based software package that offers automated/intelligent add-on sales, customer surveys and reminders to book next year. ERS then. With the help of Capterra, learn about Event Rental Systems - features, pricing plans, popular comparisons to other Rental products and more. Managing the intricacies of event equipment rentals manually often leads to inefficiencies and higher costs due to potential errors. Our advanced event rental. What is "full price"? First of $15k in Audio Visual is not a lot of money for most systems. Secondly 10% is ludicrous. Full price is however. Event Rental Systems user reviews from verified software and service customers. Explore ratings, reviews, pricing, features, and integrations offered by the. Review of Event Rental Systems Software: system overview, features, price and cost information. Get free demos and compare to similar programs. The bounce house rental software created by Event Rental Systems is the perfect solution to streamline and elevate your business in a cost-effective and. Create an Event Rental Systems account and start taking orders now! Most Popular. STANDARD, PRO+, ELITE *. Items. Items, $/mo, $/mo. In addition to the monthly subscription fee (see our pricing page for a listing of monthly fees), there is an annual fee of $99 to host your website. Note, even. Event Rental Systems is a web-based software package that offers automated/intelligent add-on sales, customer surveys and reminders to book next year. ERS then. With the help of Capterra, learn about Event Rental Systems - features, pricing plans, popular comparisons to other Rental products and more. Managing the intricacies of event equipment rentals manually often leads to inefficiencies and higher costs due to potential errors. Our advanced event rental. What is "full price"? First of $15k in Audio Visual is not a lot of money for most systems. Secondly 10% is ludicrous. Full price is however. Event Rental Systems user reviews from verified software and service customers. Explore ratings, reviews, pricing, features, and integrations offered by the. Review of Event Rental Systems Software: system overview, features, price and cost information. Get free demos and compare to similar programs. The bounce house rental software created by Event Rental Systems is the perfect solution to streamline and elevate your business in a cost-effective and. Create an Event Rental Systems account and start taking orders now! Most Popular. STANDARD, PRO+, ELITE *. Items. Items, $/mo, $/mo.

Tent Rental Systems · 1 - 50 ITEMS $ · 51 - ITEMS $ · + ITEMS $ · Set Up Fee $ Event Rental Systems (ERS) is an innovative cloud-based party rental software service that streamlines the operations and allows customers to place orders. Learn about the key aspects of accurate software pricing before you make your purchase decision: Pricing models & ranges, unexpected costs and pricing of. ERS is a cloud-based party rental software package that allows your customers to order online while viewing real-time availability. Everything that can be. Learn more about Event Rental Systems pricing plans including starting price, free versions and trials. Solution: Now with Point of Rental Software, customers can access their own account through Price Rentals' web portal, where they can see their quotes. % plus per transaction + an estimated % Card Brand/Pass-through fees. Chargeback Fee: $25 Per Item; Reconcile directly from your ERS CP. Event Rental Systems, Inc., Albuquerque, New Mexico. K likes · 35 talking about this · 4 were here. The premiere software solutions to supercharge. Event Rental Systems offers party rental software including websites for inflatable rentals, laser tag. Online ordering, routing, scheduling. Rentopian is an online party event rentals software that helps businesses manage inventory, streamline operations, & grow their rental bookings. Free demo! Pricing based on items that rent for $65 or more. Standard: $/month for items. Pro: $/month for items. Find out more about Event Rental Systems starting price, setup fees, and more. Read reviews from other software buyers about Event Rental Systems. Loyalty Programs | Top Party Rental Software | | [email protected] · Optimizing Sales - High Demand Pricing · Automated Upselling After the. Bounce House rentals for the Albuquerque area - slide, jump, moonwalk and jumpers for every event. Tables, chairs and concessions for rent. Log In to your ERS control panel Don't have an account? () © Event Rental Systems All rights reserved. Powered by Event Rental Systems. Event Rental Systems FAQs · Standard at $ per month. · Pro+ at $ per month. · Elite* at $ per month. Learn more about. Unique features include reservations by event date, automatic availability handling, damage waivers, industry insurance discounts, pricing based on the length. Event rental systems software saves LOTS of Time and Money. How do we know? For starters, we made this for our own bounce house rental company. When we. Event Rental Systems. Events Services. Albuquerque, New Mexico followers. Put your event rental business on auto pilot with our industry leading software. Q. What type of pricing plans does Event Rental Systems offer? Event Rental Systems offers the following pricing plans: Starting from: US$/month; Pricing.

Portfolio Recovery Pra Inc

Portfolio Recovery Associates, LLC is a wholly owned subsidiary of debt buying giant PRA Group, Inc. Most consumers interface with PRA Group's wholly owned. Portfolio Recovery Associates, Inc. Portfolio Recovery Associates, LLC (PRA LLC). Corporate Boulevard. Norfolk, VA What. PRA Group, Inc. is a publicly-traded debt buyer and debt collection company based in Norfolk, Virginia. The company buys delinquent consumer debt from credit. PORTFOLIO RECOVERY ASSOCIATES, LLC is a trademark of PRA Group, Inc.. Filed in July 20 (), the PORTFOLIO RECOVERY ASSOCIATES, LLC covers Debt recovery. Matters: Matters of interest to PRA Group, Inc. Information on this page comes from public documents on file with the office of the Virginia Conflict of. ) (quotation omitted). Corral v. Select Portfolio Servicing, Inc., F PRA's Cost Bill, PRA's Notice of Errata to Cost Bill, Ms. Duvall's. Portfolio Recovery Associates (PRA) is one of the largest debt collectors/debt buyers in the United States. To stop the phone calls, I would recommend sending. Have you been sued by Portfolio Recovery Associates and need help to defend the lawsuit or settle the debt? If so, contact Graham & Borgese. On December 19, , Portfolio Recovery Associates, Inc. (PRA) entered into a new secured credit agreement (the Credit Agreement) by and among PRA. Portfolio Recovery Associates, LLC is a wholly owned subsidiary of debt buying giant PRA Group, Inc. Most consumers interface with PRA Group's wholly owned. Portfolio Recovery Associates, Inc. Portfolio Recovery Associates, LLC (PRA LLC). Corporate Boulevard. Norfolk, VA What. PRA Group, Inc. is a publicly-traded debt buyer and debt collection company based in Norfolk, Virginia. The company buys delinquent consumer debt from credit. PORTFOLIO RECOVERY ASSOCIATES, LLC is a trademark of PRA Group, Inc.. Filed in July 20 (), the PORTFOLIO RECOVERY ASSOCIATES, LLC covers Debt recovery. Matters: Matters of interest to PRA Group, Inc. Information on this page comes from public documents on file with the office of the Virginia Conflict of. ) (quotation omitted). Corral v. Select Portfolio Servicing, Inc., F PRA's Cost Bill, PRA's Notice of Errata to Cost Bill, Ms. Duvall's. Portfolio Recovery Associates (PRA) is one of the largest debt collectors/debt buyers in the United States. To stop the phone calls, I would recommend sending. Have you been sued by Portfolio Recovery Associates and need help to defend the lawsuit or settle the debt? If so, contact Graham & Borgese. On December 19, , Portfolio Recovery Associates, Inc. (PRA) entered into a new secured credit agreement (the Credit Agreement) by and among PRA.

It uses several business names in addition to Portfolio Recovery Associates, including PRA III, and Anchor Receivables Management. Choice Recovery Inc. PRA is a legit company. The largest debt collector in the US. Publicly traded. I would agree with asking them to send you the proof of dept by mail. PRA, LLC is a subsidiary of PRA Group, Inc.—a publicly traded (Nasdaq: PRAA) company employing close to 4, people across the Americas and Europe. Portfolio Recovery Associates, Inc. (PRA), a US market leader in the consumer debt purchase and collection industry, for a price of US$53 million. Mackenzie. Portfolio Recovery Associates LLC, a subsidiary of PRA Group, Inc., specializes in working with people in debt repayment. What is the Resident Agent address of PRA to serve them? · Registered Agent Information · CORPORATION SERVICE COMPANY · Shockoe Slip · Fl 2 · Richmond, VA, Portfolio Recovery Associates, LLC (PRA, LLC) was founded in and is one of the nation's largest debt collectors. PRA, LLC is a subsidiary of PRA Group, Inc. Portfolio Recovery Associates, LLC (PRA LLC). If you've show more. Portfolio Recovery Associates Reviews. The WalletHub rating is comprised of reviews from. Portfolio Recovery Associates (PRA) is a real debt collection agency that Legal Rights Advocates, Inc. Based on reviews. powered by Google. Portfolio Recovery Associates, LLC, is owned by PRA Group, Inc., and is one of the largest buyers of charged-off debt. Often referred to as “junk debt buyers,”. PRA Group delivers nonperforming loan solutions that drive success through a long-term focus and customer care. Portfolio Recovery Associates, LLC (PRA, LLC) was founded in and is one of the nation's largest debt collectors. PRA, LLC is a subsidiary of PRA Group, Inc. and PRA Group, Inc., Complaints and Lawsuits. CFPB Debt Collection Complaint Ranking*. #2 of 2, Corp Solutions · Zwicker & Associates, PC · Rausch Sturm · Kass Shuler Portfolio Recovery Associates (PRA), one of the United States' largest debt. In addition to owning Portfolio Recovery Associates, PRA Group, Inc. also owns several subsidiaries including MuniServices, LLC, PRA Receivables Management, LLC. Frank LLP has filed a class action lawsuit against Portfolio Recovery Associates, LLC (“PRA”), and Malen & Associates, PC (“Malen) (together with PRA, the “. If information is missing from this page, it is not in the The West Virginia Secretary of State's database. PORTFOLIO RECOVERY ASSOCIATES, L.L.C. PRA GROUP. () Portfolio Recovery Associates (PRA) in was the Portfolio Investment Exchange, Inc. Portfolio Recovery Associates · Precision. Portfolio Recover is also known as PRA, Portfolio Recovery Associates, and Portfolio Recovery Associates LLC. It is a publicly-traded corporation (a rarity. RDS is a wholly owned subsidiary of Portfolio Recovery Associates. (PRA), devoted exclusively to providing administrative, management and back-office revenue.

What Does Tax Deductible Mean

With the $1, tax credit, your tax bill is reduced to $2, With a tax deduction, it lowers your taxable income. So, if you're in the 12% tax bracket, that. One tax deduction that is easily overlooked is called “carrying charges and interest expenses.” Carrying charges are expenses you incur for the purpose of. A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe. In income tax statements, this is a reduction of taxable income, as a recognition of certain expenses required to produce the income. A pre-tax deduction is any money taken from an employee's gross pay before taxes are withheld from their paycheck. These deductions reduce the employee's. Deductible in tax law (referred to as a tax deductible) means an item or expense that can reduce the taxes a person owes in a given year. A tax deduction is a provision that reduces taxable income, as an itemized deduction or a standard deduction that is a single deduction at a fixed amount. A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. A tax deduction is a business expense that can lower the amount of tax you have to pay. It's deducted from your gross income to arrive at your taxable income. With the $1, tax credit, your tax bill is reduced to $2, With a tax deduction, it lowers your taxable income. So, if you're in the 12% tax bracket, that. One tax deduction that is easily overlooked is called “carrying charges and interest expenses.” Carrying charges are expenses you incur for the purpose of. A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe. In income tax statements, this is a reduction of taxable income, as a recognition of certain expenses required to produce the income. A pre-tax deduction is any money taken from an employee's gross pay before taxes are withheld from their paycheck. These deductions reduce the employee's. Deductible in tax law (referred to as a tax deductible) means an item or expense that can reduce the taxes a person owes in a given year. A tax deduction is a provision that reduces taxable income, as an itemized deduction or a standard deduction that is a single deduction at a fixed amount. A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. A tax deduction is a business expense that can lower the amount of tax you have to pay. It's deducted from your gross income to arrive at your taxable income.

No, a tax deduction does not mean it's free. (Sorry.) Instead, a deduction lowers the amount of income you're taxed on. For example, let's say you make $5, Personal deductions · Qualified residence interest. · State and local income or sales taxes and property taxes up to an aggregate of USD 10, · Medical expenses. The purpose of charitable tax deductions are to reduce your taxable income and your tax bill—and in this case, improving the world while you're at it. 1. How. % tax deductions. Does this mean that, once my taxes are filed with this deduction included, I'll be able to subtract % of the cost of the museum. Deduction in tax law (referred to as a tax deductible) means an item or expense that can reduce the taxes a person owes in a given year. Required by law, such as federal and provincial tax For other types of PPE, employers must ensure that workers use the equipment (that is, does not stipulate. What Does Tax Deductible Mean Tax-deductible expenses are expenses you can legally deduct from your total profits. This reduces your gross profits and hence. % tax deductions. Does this mean that, once my taxes are filed with this deduction included, I'll be able to subtract % of the cost of the museum. A tax-deductible business expense is any cost incurred by an organization that can be subtracted from its taxable income, thereby reducing its tax liability. A tax deductible expense is any expense that is considered "ordinary, necessary, and reasonable" and that helps a business to generate income. It means that you can subtract it from your income. Depending on what you do for a living or what investments you make there are ways you can. The purpose of charitable tax deductions are to reduce your taxable income and your tax bill—and in this case, improving the world while you're at it. 1. How. Income Tax Return Deductions · Expenses for income from personal property rental · Nontaxable amount of the value of Olympic/Paralympic medals or USOC prize money. This section of the tax code allows a business to write off the full cost of certain expenses and equipment. That means instead of depreciating items (and. A tax deduction, sometimes referred to as a tax write-off, is any legitimate expense that can be subtracted from your taxable income. What Is a Tax Deduction and How Does It Work? A tax deduction lets you subtract certain expenses from your income before you file taxes. You are then taxed. The Value Added Tax (VAT) right to deduction refers to a taxable person's right to claim from tax authorities the VAT they paid on the goods and services. Most business expenses are either fully or partially tax deductible. Small business owners try to do a tax write-off on as many expenses as possible to gain. A fixed amount ($20, for example) you pay for a covered health care service after you've paid your deductible. Refer to glossary for more details. or.

Using Equity For Renovations

One of the most cost-effective options to fund a renovation project is to consider releasing this equity from your home by way of a remortgage or further. HELOC can help homeowners fund small renovation projects throughout their forever home as well. Additional Resources. Homeowners can use home equity to finance home remodeling projects by taking out a home equity loan or line of credit. Because they are secured by the equity in your home, these loans may have much lower interest rates than unsecured debt, such as credit cards and personal loans. You only need 3% equity to refinance; Combines purchase/refinance price with renovation costs into a single loan; You can use it on investment properties; No. Your home is a major investment, but it's also one in which you live, work, and make memories. Using home equity to make home improvements, without debt. You can use a loan increase to fund a renovation that costs $k or less, as this is considered a standard or cosmetic renovation and might cover things like. You don't have to have paid off all your mortgage – you can remortgage to a lifetime mortgage and pay off the rest of your mortgage using the money you access. The Benefits of Using Home Equity for Home Improvements · Enhancing Home Value · Potential for Tax Deductions · Interest paid on home equity loans or lines of. One of the most cost-effective options to fund a renovation project is to consider releasing this equity from your home by way of a remortgage or further. HELOC can help homeowners fund small renovation projects throughout their forever home as well. Additional Resources. Homeowners can use home equity to finance home remodeling projects by taking out a home equity loan or line of credit. Because they are secured by the equity in your home, these loans may have much lower interest rates than unsecured debt, such as credit cards and personal loans. You only need 3% equity to refinance; Combines purchase/refinance price with renovation costs into a single loan; You can use it on investment properties; No. Your home is a major investment, but it's also one in which you live, work, and make memories. Using home equity to make home improvements, without debt. You can use a loan increase to fund a renovation that costs $k or less, as this is considered a standard or cosmetic renovation and might cover things like. You don't have to have paid off all your mortgage – you can remortgage to a lifetime mortgage and pay off the rest of your mortgage using the money you access. The Benefits of Using Home Equity for Home Improvements · Enhancing Home Value · Potential for Tax Deductions · Interest paid on home equity loans or lines of.

Home equity is a valuable asset that can improve virtually any aspect of your home. From stylish kitchen renovations to energy-efficiency upgrades, a home. But if your renovations will be extensive, a construction loan, refinance or home equity loan might make more sense. [download_section]. Can You Use a Credit. With a HELOC, you borrow against your equity – which is your home's value minus the amount you owe on the mortgage. Essentially, a HELOC functions as a second. Home Equity Loans – Once your home has established some excess value (equity), many homeowners choose to take out a home equity loan, which is a lump sum with a. Using a home equity loan for renovations offers numerous benefits, from lower interest rates and tax deductibility to the potential for significant home value. A Home Equity Release refinance to a cheaper rate may help preserve more home equity for spouses, children or other beneficiaries. This guide will cover home equity loans for remodeling —how they work, when to use them, and which one to choose. A home equity loan works in a similar way to a traditional mortgage. Except instead of financing the purchase of your home, you're using the equity that you've. Home equity loans can be a good option for homeowners who have built up equity in their property and want to make substantial renovations. However, borrowers. There are two main ways you can access the equity in your home by refinancing - a cash out loan or a line of credit. If you are looking to fund any on going home repairs through the home equity, then it's a very risky proposition. The equity in the home could. If you're short on cash to complete your home renovation, you can combine the two FHA no-equity loan programs to increase your borrowing power. The (k) loan. We use an appraiser to determine what the value of your home will be after renovations, so that you're able to borrow the money (up to 90% loan-to-value) that. Some home owners choose to use the equity in their home as collateral to cover home improvements or unexpected personal expenses. A Home Equity Loan provides a. Using the equity in your home can be one way to help fund your home renovation; refinancing your home loan is another. A renovation is a great way to both add value to the property, but will also make it a nice place to live and more attractive to potential buyers if you choose. Using home equity financing · You must use the funds to substantially improve the home (not for personal use or debt consolidation) · A “substantial improvement”. Use your equity · Use redraw (if available) · Refinance your existing home loan · Apply for a personal loan · Consider a building and construction loan · See if you'. A HELOC is a revolving line of credit, which gives homeowners the ability to borrow from their home's equity a certain amount of money and access the funds as.

Do I Need A Financial Advisor When I Retire

How Much Retirement Income Do I Need? Your retirement goals and your We recommend that you seek advice from an independent financial advisor before making any. Retirement plans are just the beginning Preparing for the future means building momentum toward whatever you want to pursue. Your retirement years bring the. The answer is a resounding maybe. Because qualified planners are trained to deal with myriad personal financial topics, they can help you set financial goals. As employer investment and retirement options multiply, most workers find that managing their personal finances takes more than a few minutes with a. The answer is a resounding maybe. Because qualified planners are trained to deal with myriad personal financial topics, they can help you set financial goals. Financial Planners. If you need a retirement roadmap or want to review and strengthen your current plan, a certified financial planner (CFP) can offer guidance. Yes, you will do better with a financial planner if you are unfamiliar with the simple economics of compound interest, the time value of money. You should also review any questions particular to your age. For example, planning for health care is one of the big unknowns in retirement, and a financial. Approaching retirement. Ask. The times in your life when you may need an advisor. Inheriting money. Ask. How Much Retirement Income Do I Need? Your retirement goals and your We recommend that you seek advice from an independent financial advisor before making any. Retirement plans are just the beginning Preparing for the future means building momentum toward whatever you want to pursue. Your retirement years bring the. The answer is a resounding maybe. Because qualified planners are trained to deal with myriad personal financial topics, they can help you set financial goals. As employer investment and retirement options multiply, most workers find that managing their personal finances takes more than a few minutes with a. The answer is a resounding maybe. Because qualified planners are trained to deal with myriad personal financial topics, they can help you set financial goals. Financial Planners. If you need a retirement roadmap or want to review and strengthen your current plan, a certified financial planner (CFP) can offer guidance. Yes, you will do better with a financial planner if you are unfamiliar with the simple economics of compound interest, the time value of money. You should also review any questions particular to your age. For example, planning for health care is one of the big unknowns in retirement, and a financial. Approaching retirement. Ask. The times in your life when you may need an advisor. Inheriting money. Ask.

If you're starting to make some big decisions about retirement or want to be sure you're taking steps in the right direction, tailored financial advice may help. No matter your financial situation, if you're a senior or nearing retirement, you have specific financial concerns. You need to plan for the rising costs of. These professional certifications can enhance your credibility and are encouraged by financial advisory firms, but they're not mandatory for becoming a. #1: Find out where you stand. · #2: Boost your savings, if you need to. · #3: Plan ahead for Social Security. · #4: Consider tax-smart strategies now. · #5: Get a. The answer is a resounding maybe. Because qualified planners are trained to deal with myriad personal financial topics, they can help you set financial goals. If you want retirement planning, tax strategies, and estate planning advice, then hire an advisor. You can find a fee only advisor and pay. Whether you're a few decades or a few years away from retirement, having a plan can help you feel confident that you'll be ready when the time comes. A dual-licensed Canada and US financial advisor can inform you on how to keep your retirement accounts intact and avoid receiving a letter stating you have NewRetirement Advisors do that, but they are also experts in how to turn your savings into retirement income, get the best insurance options, understand risks. Financial advisors will also provide services and advice on a wide range of topics such as investment planning, insurance needs, tax planning, and retirement. In general, the most common reason to hire an advisor is to get help with investments. But, investing is not the only thing advisors do. In fact, not all. Financial Planners should have the breadth and depth of knowledge to develop integrated financial plans for clients, and be knowledgeable in all core personal. These are the key years that can make or break a retirement. Hire a financial planner for retirement to ensure you're making the correct financial decisions to. To realize that vision, you'll need a plan just as detailed. Your Raymond James advisor will work closely with you to understand your personal goals – when you. While it's not mandatory to seek financial advice when starting or investing in a pension, it may still be a good idea to speak with an expert. Step 2: Needs — Determine your retirement needs. Once you have an Financial planners do not manage your money, but will assess your present financial. Some people fail to account for taxes in their retirement plan, leaving them with a nasty surprise later on. Your financial advisor can help prepare you for the. Financial advisors carry out financial planning and offer investment advice usually as those relate to long terms savings or retirement planning. If you're on the fence about teaming up with a financial advisor, it's important to consider where you are now and where you want your money to be in the near. Advisers can provide expert guidance when you have important and potentially difficult financial decisions to make, such as approaching retirement. An adviser.