capitolovo.ru

Overview

Best Balance Transfer Credit Cards 2021

This card is a good choice for consumers looking for the longest grace period for both balance transfers and purchases. It offers 21 billing cycles of 0% APR on. Bank of America Unlimited Cash Rewards World Mastercard, $4,, August US Bank Platinum Visa, $6,, January AMEX Everyday. Best Credit Card for Extended Intro APR Period on Balance Transfers. Wells Fargo Reflect® Card. Low Intro APR Balance Transfer + Earn 30K Bonus Points. With a More Rewards Card, you could get a low intro APR on balance transfers for 12 months. Best balance transfer credit cards in Ireland · Ulster Bank transfer balance credit card: One of the elusive 'triple-zero' credit cards mentioned above. · An. Annual fee · No Late Fees, No Penalty Rate, and No Annual Fee · 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR. A balance transfer can help save you money by moving your debt to a card with a lower APR. See our picks for best balance transfer credit cards. No balance transfer fees and no annual fees with any of our credit cards. Credit card rates at SCCU do not exceed 18% APR*. Visa Signature® 45, Visa® Platinum. Balance transfer credit cards ; Citi Simplicity® Card · reviews · 0% for 21 Months ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Double Cash® Card. This card is a good choice for consumers looking for the longest grace period for both balance transfers and purchases. It offers 21 billing cycles of 0% APR on. Bank of America Unlimited Cash Rewards World Mastercard, $4,, August US Bank Platinum Visa, $6,, January AMEX Everyday. Best Credit Card for Extended Intro APR Period on Balance Transfers. Wells Fargo Reflect® Card. Low Intro APR Balance Transfer + Earn 30K Bonus Points. With a More Rewards Card, you could get a low intro APR on balance transfers for 12 months. Best balance transfer credit cards in Ireland · Ulster Bank transfer balance credit card: One of the elusive 'triple-zero' credit cards mentioned above. · An. Annual fee · No Late Fees, No Penalty Rate, and No Annual Fee · 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR. A balance transfer can help save you money by moving your debt to a card with a lower APR. See our picks for best balance transfer credit cards. No balance transfer fees and no annual fees with any of our credit cards. Credit card rates at SCCU do not exceed 18% APR*. Visa Signature® 45, Visa® Platinum. Balance transfer credit cards ; Citi Simplicity® Card · reviews · 0% for 21 Months ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Double Cash® Card.

A credit card balance transfer works by allowing you to move balances from one card to another, ideally at a lower interest rate, helping you to pay. A balance transfer credit card allows you to move existing debt onto it when you open your account. Ideally, you'll move your debt to the balance transfer. Limited Time Offer. Platinum Edition® Mastercard Save interest on balance transfers · No Annual Fee · % APR1 FIXED FOR LIFE until paid in full for balance. Before you read that new credit card's 0% interest balance transfer offer, see our guide to help save money and pay down your existing debt. 10 partner offers ; Blue Cash Preferred Card from American Express · 0% on Purchases and Balance Transfers for 12 months ; Citi Diamond Preferred Card · 0% for JUN 4, - If you find yourself struggling with debt and need a low interest credit card, the HSBC Gold Mastercard® credit card is a What Makes HSBC's New. Again, a credit card with no annual fees is best for a balance transfer. Annual fees can really hold you back! Our Robins Financial Credit Union Visa Platinum. Chase Sapphire Preferred® Card: Best feature: Travel rewards. Discover it® Cash Back: Best feature: Cash back on everyday purchases. Citi Rewards+® Card: Best. Credit card balances have risen by $ billion since the first quarter of Best Balance Transfer Credit Cards · Best No Balance Transfer Fee Credit. According to the Federal Reserve's Consumer Credit survey, as of late the average rate being charged on credit card balances was %. Naturally, if. Read up on the latest advice and guides from the Bankrate team all about balance transfers. We'll help you find the best card, execute a successful balance. The Choice Rewards World Mastercard® from First Tech Federal Credit Union is a well-rounded card that has no annual fee, no foreign transaction fees, and a. signature card design. Best Save more when you transfer your high-rate credit card debt to Central One. No balance transfer fees or annual fees. Special Connections® Credit Card rewards you with up to 3% cash back. No Annual Fee. Unlimited Cash Back. Choose from Visa® or Mastercard®. A 3% balance transfer fee is applicable to these balance transfers. This offer is available on the Platinum VISA and the Platinum Rewards VISA credit cards only. BankAmericard® credit card · Bank of America® Customized Cash Rewards credit card · Discover it® Cash Back · Discover it® Chrome · Citi® Double Cash Card · Capital. Credit card balances have risen by $ billion since the first quarter of Best Balance Transfer Credit Cards · Best No Balance Transfer Fee Credit. I applied for a credit card, requesting a balance transfer of $5, The Bank mailed my card and account agreement but only approved a $1, credit limit. Taking into account all factors (e.g., introductory balance transfer APR, ongoing balance transfer APR, and rewards), our favorite credit card for balance. By transferring all of your independent credit card debt to one singular credit card with FCCU, you can not only benefit from a much lower interest rate but.

Fixed Income And Interest Rates

This fluctuation is in response to the current interest rate environment. Since bonds cannot change their coupon rates to align with current interest rates. Fixed-rate bond - a bond with a fixed coupon rate. Floating rate bond - a bond with a variable coupon, usually tied to a reference interest rate, such as the. Rising interest rates have a significant impact on a fixed income portfolio: as interest rates increase, bond prices typically decrease, which can lead to. How to build a framework for forecasting interest rate market movements With trillions of dollars worth of trades conducted every year in everything from. We expect growth to slow and interest rates to drop, which we believe should generate solid total return potential for bond investors. Explore Our Outlook. The ongoing yield curve normalization suggests an opportunity to add interest rate exposure back into fixed income portfolios. These dynamics also position. (Many bonds pay a fixed rate of interest throughout their term; interest payments are called coupon payments, and the interest rate is called the coupon rate.). However, Treasury bonds (as well as other types of fixed income investments) are sensitive to interest rate risk, which refers to the possibility that a rise in. What is Fixed Income Interest Rate Risk? Fixed income interest rate risk is the risk of a fixed income asset losing value due to a change in interest rates. This fluctuation is in response to the current interest rate environment. Since bonds cannot change their coupon rates to align with current interest rates. Fixed-rate bond - a bond with a fixed coupon rate. Floating rate bond - a bond with a variable coupon, usually tied to a reference interest rate, such as the. Rising interest rates have a significant impact on a fixed income portfolio: as interest rates increase, bond prices typically decrease, which can lead to. How to build a framework for forecasting interest rate market movements With trillions of dollars worth of trades conducted every year in everything from. We expect growth to slow and interest rates to drop, which we believe should generate solid total return potential for bond investors. Explore Our Outlook. The ongoing yield curve normalization suggests an opportunity to add interest rate exposure back into fixed income portfolios. These dynamics also position. (Many bonds pay a fixed rate of interest throughout their term; interest payments are called coupon payments, and the interest rate is called the coupon rate.). However, Treasury bonds (as well as other types of fixed income investments) are sensitive to interest rate risk, which refers to the possibility that a rise in. What is Fixed Income Interest Rate Risk? Fixed income interest rate risk is the risk of a fixed income asset losing value due to a change in interest rates.

This higher up-front price compensates the seller for giving up the additional coupon income over the remaining life of the bond. Likewise, a bond with a below-. It starts with basic statistics and bond math as well as giving you a good overview of important fixed income market participants before diving deeper into. For bond investors who believe interest rates are rising, the most obvious choice is to reduce the duration of their bond portfolios. Duration measures the. Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates Bloomberg Fixed Income Indices. In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This higher up-front price compensates the seller for giving up the additional coupon income over the remaining life of the bond. Likewise, a bond with a below-. With the anticipation of further rate hikes from the Fed, investors naturally are concerned with how their fixed income investments would be affected. The Fed's. Protect against inflation. The interest rate on a particular I bond changes every 6 months, based on inflation. Current Rate: %. This includes a fixed rate. Market and benchmark interest rate movements affect fixed income prices significantly. When market interest rates rise, bond prices fall. Conversely, when. Schroders guide on understanding fixed income & bonds - Learn more about bonds, their mechanics, and the different types. Generally speaking, these securities have a fixed rate of interest (coupon) and a specific term. Interest is paid during this term and the bond is repaid . Interest rate swaps are an integral part of the fixed income market. These derivative contracts, which typically exchange – or swap – fixed-rate interest. Fixed-income securities are debt instruments issued by a government, corporation or other entity to finance and expand their operations. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive. Bond prices and interest rates have an inverse relationship: When interest rates rise, bond prices fall and vice versa—just like a see saw. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive. Zero coupon bonds are exactly what they sound like - bonds with a 0% interest rate. These are a unique type of bond; most bonds have interest rates above 0%. When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant, and yields go up. Conversely, when interest rates. Investors who own fixed income securities should be aware of the relationship between a bond's price and interest rates. As a general rule, the price of a bond.

Loan Defeasance Definition

typical refinancing fits within the definition. This is discussed in further detail in Section V with respect to a borrower's review of loan documents in. defeasance whereby debt is removed from the balance sheet but not cancelled. Related Terms: Defeasance. Practice whereby the borrower sets aside cash or bonds. Defeasance is the process through which a borrower is released from the financial obligations of its debt. The borrower purchases a portfolio of government. The borrower gets full title to the property. · The lender sells the property. · The borrower takes out an additional mortgage. · The lender securitizes the loan. part of the permanent financing, meaning that the Bridge Loans are committed can take the form of Covenant Defeasance or Legal Defeasance. Legal. A provision in a loan or bond removing it as a liability on a balance sheet if cash or a portfolio is set aside for debt service. Usually defeasance occurs when. Defeasance is a process by which a borrower who had previously entered into a CMBS loan can unencumber themselves prior to the maturity of the loan. Defeasance Loan Those Mortgage Loans which provide the related Mortgagor with the option to defease the related Mortgaged Property. Defeasance Collateral means. In a legal context, defeasance renders the outstanding bonds paid thereby removing all obligations of the issuer for payment of the bonds. In order for a bond. typical refinancing fits within the definition. This is discussed in further detail in Section V with respect to a borrower's review of loan documents in. defeasance whereby debt is removed from the balance sheet but not cancelled. Related Terms: Defeasance. Practice whereby the borrower sets aside cash or bonds. Defeasance is the process through which a borrower is released from the financial obligations of its debt. The borrower purchases a portfolio of government. The borrower gets full title to the property. · The lender sells the property. · The borrower takes out an additional mortgage. · The lender securitizes the loan. part of the permanent financing, meaning that the Bridge Loans are committed can take the form of Covenant Defeasance or Legal Defeasance. Legal. A provision in a loan or bond removing it as a liability on a balance sheet if cash or a portfolio is set aside for debt service. Usually defeasance occurs when. Defeasance is a process by which a borrower who had previously entered into a CMBS loan can unencumber themselves prior to the maturity of the loan. Defeasance Loan Those Mortgage Loans which provide the related Mortgagor with the option to defease the related Mortgaged Property. Defeasance Collateral means. In a legal context, defeasance renders the outstanding bonds paid thereby removing all obligations of the issuer for payment of the bonds. In order for a bond.

Property owners use defeasance to essentially "prepay" their loan without actually paying it off early, which might be prohibited under the loan terms. In a CMBS transaction, single mortgage loans of varying type, size, and location were pooled into a trust called a Real Estate Mortgage Investment Conduit. (“. Not retaining this right may prevent the borrower from sharing in any prepayment residual value generated by the successor borrower. Definition of Defeasance. Loan Defeasance. Status. Defeasance Status. Indicates if a mortgage loan Associated Loan. Number. See Loan Number definition. Associated Transaction. ID. Defeasance is the ability of a borrower to repay a mortgage early without being charged prepayment penalties. “Repayment Date” shall mean the date of a defeasance or prepayment (as applicable) of the Loan pursuant to the provisions of Section hereof. “Reserve. Note: It is rare for Loan Servicers to allow defeasance to the start of this Negotiate the definition of the securities eligible to be used as defeasance. In commercial real estate, defeasance is the replacement of the collateral of a loan with securities whose value provides the lender with an equivalent return. Usually, defeasance occurs when a borrower owns a portfolio of Treasury securities whose coupons are used to service a debt. When the borrower has set aside. The process involves the remainder of the amount owing on the loan being used to purchase government securities which are then given to the lender in exchange. In another context, defeasance is a method to reduce the fees, when the borrower urges to prepay a fixed rate commercial real estate loan. The repayment may be. mortgages” as, by definition, an obligation is a “qualified mortgage” only First, the borrower's loan documents must “allow for” the defeasance. Successor borrower rights are a material defeasance consideration, not just at the time of defeasance but at loan origination as well. Defeasance is a provision in an instrument, such as leases and loans, that makes certain conditions void if specified actions are taken. A Defeasance Commitment Fee equal to 1% of the scheduled balance of the Mortgage LoanMortgage LoanMortgage debt obligation evidenced, or when made will be. In the CMBS industry, defeasance is the process by which the real estate and related collateral securing a mortgage loan is replaced by government securities . Defeasance Holding Company (DHC) has been providing Successor Borrower services to return residual value to originators, borrowers, and servicers for over The process is especially popular for borrowers of commercial mortgage-backed securities (CMBS) loans. Beginning in , conduit borrowers looking to extract. ✓ Defeasance is commonly used in commercial real estate transactions to allow a borrower to prepay a loan earlier than its maturity date. (Source: APEX Mortgage. defeasance, or a combination thereof over the loan term. Learn. Glossary mortgages in a sequential, defined manner. Early prepayments or extended.

Benefits Of Using A Mortgage Broker

1. Using a Mortgage Broker Can Save You Time · 2. Brokers May Have Access to More Loan Options · 3. You'll Likely Get Lower Interest and Other Costs · 4. A. Mortgage brokers are financial specialists who compare lenders and home loan products to ensure their clients secure the right deal for them. 7 benefits of using a mortgage broker · You'll save time · You could save money · You'll get access to more products · You'll get expert financial advice · You'. A professional mortgage broker knows how to value your time. You can make appointments at the most convenient time and place for you – whether it is after work. Working with a mortgage broker can potentially save you time, effort, and money. · A mortgage broker may have better and more access to lenders than you have. The benefits of using a mortgage broker for your mortgage are that they shop multiple lenders on your behalf, they have access to a wide range of loan programs. With access to a wide range of mortgage products, a broker is able to offer you the greatest value in terms of interest rate, repayment amounts, and loan. Advantages of Using a Mortgage Broker. A broker can assist a client with fee management concerning their desire to obtain a mortgage or approach a new lender. Using a mortgage broker offers numerous benefits compared to going directly to a lender. From access to multiple lenders and customized mortgage solutions. 1. Using a Mortgage Broker Can Save You Time · 2. Brokers May Have Access to More Loan Options · 3. You'll Likely Get Lower Interest and Other Costs · 4. A. Mortgage brokers are financial specialists who compare lenders and home loan products to ensure their clients secure the right deal for them. 7 benefits of using a mortgage broker · You'll save time · You could save money · You'll get access to more products · You'll get expert financial advice · You'. A professional mortgage broker knows how to value your time. You can make appointments at the most convenient time and place for you – whether it is after work. Working with a mortgage broker can potentially save you time, effort, and money. · A mortgage broker may have better and more access to lenders than you have. The benefits of using a mortgage broker for your mortgage are that they shop multiple lenders on your behalf, they have access to a wide range of loan programs. With access to a wide range of mortgage products, a broker is able to offer you the greatest value in terms of interest rate, repayment amounts, and loan. Advantages of Using a Mortgage Broker. A broker can assist a client with fee management concerning their desire to obtain a mortgage or approach a new lender. Using a mortgage broker offers numerous benefits compared to going directly to a lender. From access to multiple lenders and customized mortgage solutions.

A mortgage broker can assess your financial situation, understand your homeownership goals, and recommend loan options that align with your needs. Another advantage is that many large direct mortgage lenders are licensed nationwide, which means that they can help buyers from any state. When a borrower is. Mortgage brokers in Michigan are all licensed by the National Mortgage Licensing System (NMLS) and the state of Michigan. To be a licensed Mortgage Broker you. Engaging a mortgage agent/broker offers consumers access to a wider selection of mortgage products, expert guidance, time savings, tailored solutions, and. Save Money: A mortgage broker can help you save money by finding the best loan products and rates available. This can add up to significant. With access to a wide range of mortgage products, a broker is able to offer you the greatest value in terms of interest rate, repayment amounts, and loan. Duties of Mortgage Brokers As a financial advisor might point you in the direction of the best investment basket for your money, a mortgage broker is supposed. Helps you find favorable rates. Mortgage brokers have access to wholesale mortgage rates, which are lower than commercial banks with higher overhead costs. A mortgage broker in Australia can offer a hassle-free alternative that not only saves time but also money, ensuring you secure the best loan and interest. What Are the Benefits of Using a Mortgage Broker? If you were comparing several lenders on your own, you would be responsible for communicating with all of. A mortgage broker is a professional who specializes in helping people secure home loans from a variety of lenders. 1. Get the best deal for you. A mortgage broker can look around for the best deal on your behalf while considering your specified demands and circumstances. Advantages of Using a Mortgage Broker · Customer Service: · Communication: · Variety of Programs: · Faster Loan Closings: · Better Rates and Lower Fees: · You're. As impartial experts, mortgage brokers specialize in finding you the best mortgage products at fair and competitive interest rates. They'll work with you to. A mortgage adviser can save you time, stress, and money – and you don't need to pay a cent for their services. Here are the top six benefits of using one. Advantages · Mortgage brokers can save borrowers time and effort by finding a variety of potential lenders for them. · They can help borrowers avoid lenders who. The benefits of using a mortgage broker for your mortgage are that they shop multiple lenders on your behalf, they have access to a wide range of loan programs. What Is a Mortgage Broker? A mortgage broker helps lenders and borrowers connect with each other. · 1. Financial Advice · 2. Efficiency · 3. Negotiate on Your. A mortgage broker can help you find the best loan for your specific needs. A broker can help you compare interest rates, terms, and fees from multiple lenders. A mortgage broker in Australia can offer a hassle-free alternative that not only saves time but also money, ensuring you secure the best loan and interest.

Skills For Coding

Problem Solving. Problem-solving is a very important skill for coders to have, and not just the hunting down bugs. Every challenge you face in coding. More than anything, coding relies on strong logic and problem-solving skills. Is coding hard to learn? Learning to code can be difficult or frustrating at times. Your interview skills will include stuff like lettcode for Backend or html/css/js for front end or oops/ database/ operating systems /. Read our top 10 skills children can learn through coding and see how programming helps kids to develop a versatile set of skills that are useful in all areas. 9 Hard Skills Programmers Need · 1. Data Structures and Algorithms · 2. Database and SQL · 3. Object-oriented programming (OOP) languages · 4. Integrated. These ten websites offer valuable resources and opportunities for individuals looking to practice and improve their coding skills. Top 10 (Non-Tech) Skills You Learn From Coding · 1. Communication · 2. Empathy · 3. Creativity · 4. Logic · 5. Problem-solving · 6. Enterprise · 7. Abstract. Coding job requirements required for back-end development include knowledge of server-side programming languages such as Java, Python, Ruby, and PHP. The one most important skill for a programmer is programming, although most people seem to only realize half of what that that really is. I like to describe the. Problem Solving. Problem-solving is a very important skill for coders to have, and not just the hunting down bugs. Every challenge you face in coding. More than anything, coding relies on strong logic and problem-solving skills. Is coding hard to learn? Learning to code can be difficult or frustrating at times. Your interview skills will include stuff like lettcode for Backend or html/css/js for front end or oops/ database/ operating systems /. Read our top 10 skills children can learn through coding and see how programming helps kids to develop a versatile set of skills that are useful in all areas. 9 Hard Skills Programmers Need · 1. Data Structures and Algorithms · 2. Database and SQL · 3. Object-oriented programming (OOP) languages · 4. Integrated. These ten websites offer valuable resources and opportunities for individuals looking to practice and improve their coding skills. Top 10 (Non-Tech) Skills You Learn From Coding · 1. Communication · 2. Empathy · 3. Creativity · 4. Logic · 5. Problem-solving · 6. Enterprise · 7. Abstract. Coding job requirements required for back-end development include knowledge of server-side programming languages such as Java, Python, Ruby, and PHP. The one most important skill for a programmer is programming, although most people seem to only realize half of what that that really is. I like to describe the.

Here are 23 of the best coding games worth a try if you want to level up your programming skills. Instead of teaching a specific programming language, this course teaches programming fundamentals that can be helpful for any language you learn. Skills you'll. Core software development skills are essential, including a strong understanding of programming languages, data structures, algorithms, problem-solving, and. Become a better programmer. Develop your coding skills with our programming lessons. Take part in our programming challenges. 10 Skills Necessary for Coding · 1) Self-Reliance · 2) Language · 3) Logic · 4) Attention to Detail · 5) Recognition of Stupidity · 6) Abstract Thinking · 7). 10 Skills Necessary for Coding · 1) Self-Reliance · 2) Language · 3) Logic · 4) Attention to Detail · 5) Recognition of Stupidity · 6) Abstract Thinking · 7). A critical skill to becoming a coder or programmer is to practice giving error-free instructions. Today you will be writing your own code to help your. Coding skills are required in many positions, including Software Engineer, Full Stack Developer, Cybersecurity Analyst, Machine Learning Engineer, and many. Programming is undoubtedly a high-income skill. It is one of the most in-demand skills in the job market, and the demand for programmers is only increasing. Read our top 10 skills children can learn through coding and see how programming helps kids to develop a versatile set of skills that are useful in all areas. Examples of computer programmer skills · Proficiency with programming languages · Learning concepts and applying them to other problems · Mathematical skills. Why is Coding important? · 1. Coding Develops Logical and Computational Thinking · 2. Coding Improves Problem Solving Skills · 3. Coding Fosters Creativity · 4. Communication skills. Although computer programmers work alone to write code, they must have effective communication skills to coordinate work on large projects. Top Coding Skills in Importance of Coding Skills in the Evolving Tech Landscape Python: The Versatile Coding Powerhouse SQL: The. Coding is the new 21st-century skill that helps children develop logical thinking and problem-solving abilities. It also teaches them how to think creatively. Developers help create the programs and applications that we use daily, and this process hinges on programming skills since code makes up the framework of any. Coding skills are required in many positions, including Software Engineer, Full Stack Developer, Cybersecurity Analyst, Machine Learning Engineer, and many. In this article, we'll guide you through the different ways to test programming skills during the recruitment process, and explain how you can use each one. Data science is the fastest-growing job where coding skills are useful. · Coding jobs often require a bachelor's degree in a computer-related field. · Many coding. A coding practice website for all programming levels – Join a community of over 3 million developers and improve your coding skills in over 55 programming.

Average Interest On House Loan

Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Nowadays mortgage rates are closer to %. If the Fed stops raising rates then I'd anticipate mortgage rates to also stop going up. That's good news for. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. When you apply and are approved for a year fixed-rate mortgage, two things are certain. Your interest rate will not change and your mortgage will be broken. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. The current average year fixed mortgage rate fell 1 basis point from % to % on Saturday, Zillow announced. The year fixed mortgage rate on. History of Average Variable vs 5 Year Mortgage Rates ; , %, %, variable, % ; , %, %, variable, %. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Nowadays mortgage rates are closer to %. If the Fed stops raising rates then I'd anticipate mortgage rates to also stop going up. That's good news for. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. When you apply and are approved for a year fixed-rate mortgage, two things are certain. Your interest rate will not change and your mortgage will be broken. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. The current average year fixed mortgage rate fell 1 basis point from % to % on Saturday, Zillow announced. The year fixed mortgage rate on. History of Average Variable vs 5 Year Mortgage Rates ; , %, %, variable, % ; , %, %, variable, %. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms.

Mortgage interest costs, specifically, fell from % in June to 21% in July, reflecting the effects of the Bank of Canada's two quarter-point rate cuts in. interest, some or all of the fees that apply to your mortgage loan. To Ontario's housing market is currently higher than the national average. As of September 4, , the average year-fixed mortgage APR is %. Terms Explained. 4. Follow day-to-day movement in mortgage rates derived from actual lender rate sheets. Change, Change, 52 Week Range. Average Rates, Current, 1 day. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Interest costs over 30 years Over 30 years, an interest rate of % costs $, more than an interest rate of %. With the adjustable-rate mortgage. As of Sept. 6, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. A high-ratio mortgage has a principal greater than 80% of the property value. APR means the cost of borrowing for a loan expressed as an interest rate. It. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Mortgage rates as of September 5, ; % · % · % · % ; $1, · $1, · $1, · $1, See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. The national average mortgage rate is % Find out what your personal rate could be. Home Equity LoanTap into your home equity A variable rate mortgage offers a fluctuating interest rate that changes with the bank's prime lending rate. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Explore today's mortgage rates and compare home loan options. When you're ready to apply, call Navy Federal at and get pre-approved for a. It's an annual percentage rate that reflects, in addition to interest, some or all of the fees that apply to your mortgage loan. house hunting begin. As of Sept. 6, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Average Mortgage Rates, Daily ; 3 Year ARM. %. % ; Jumbo. %. % ; VA. %. % ; FHA. %. %. The Bank of Canada has held its policy interest rate stable since July , which gave some impetus to the housing market. Average Value of New Mortgage Loans. The average rate on a year fixed mortgage held steady at % as of September 5th, remaining at its lowest level since mid-May , according to Freddie.

Coinbase Custodian

This is a crypto wallet where Coinbase holds half of your private key and the device that your dapp wallet is on stores the other half. Custodial wallets. Frankfurt. Live. Coinbase Custody. Pine Street. Live. Upvest. Torstraße. Live · Deka Bank. Frankfurt am Main. Live · Solaris Digital Assets. Cuvrystraße That and having two custodians means it's fairly protected. It's not protected from the bitcoin price dropping and it with it but that's not. Coinbase Custody. Coinbase Custody stands out as a leading cryptocurrency custodial service, known for its secure and user-friendly digital asset storage. custodian that they can trust to store client funds securely.” Major Let's take a look at some of the major players. Coinbase Launches Coinbase Custody. TLDR: The government is using @coinbase as a custodian. The government is also suing @coinbase for being a custodian. Coinbase was just the quickest solution. From what I've heard most ETF providers will move to another custodian in time. Coinbase Custody is a qualified custodian. Coinbase Custody operates as a standalone, independently-capitalized business to Coinbase, Inc. Coinbase Custody. Clients can also custody more than digital assets, inclusive of 38 different chains, in one of our secure and regulated custodians. Clients may have. This is a crypto wallet where Coinbase holds half of your private key and the device that your dapp wallet is on stores the other half. Custodial wallets. Frankfurt. Live. Coinbase Custody. Pine Street. Live. Upvest. Torstraße. Live · Deka Bank. Frankfurt am Main. Live · Solaris Digital Assets. Cuvrystraße That and having two custodians means it's fairly protected. It's not protected from the bitcoin price dropping and it with it but that's not. Coinbase Custody. Coinbase Custody stands out as a leading cryptocurrency custodial service, known for its secure and user-friendly digital asset storage. custodian that they can trust to store client funds securely.” Major Let's take a look at some of the major players. Coinbase Launches Coinbase Custody. TLDR: The government is using @coinbase as a custodian. The government is also suing @coinbase for being a custodian. Coinbase was just the quickest solution. From what I've heard most ETF providers will move to another custodian in time. Coinbase Custody is a qualified custodian. Coinbase Custody operates as a standalone, independently-capitalized business to Coinbase, Inc. Coinbase Custody. Clients can also custody more than digital assets, inclusive of 38 different chains, in one of our secure and regulated custodians. Clients may have.

Coinbase Custody is a qualified custodian. Coinbase Custody operates as a standalone, independently-capitalized business to Coinbase, Inc. Coinbase Custody. Coinbase Custody, a US-based qualified custodian specializing in digital asset custody for institutions, has joined the Polymath Ecosystem. Some custodians offer hot or custodial wallets – but not both – or BitGo Trust Company, Inc serves as a qualified custodian, and likewise meets. We will take a look at Coinbase Trust, Fidelity, Bakkt, Paxos, Bitgo, Gemini Trust, Prime Trust, Kingdom Trust, and other emerging custodian providers. Securely custody a wide range of assets with our custodians, including the largest regulated qualified custodian for crypto. Move assets in and out of cold. This Custody Agreement is entered into between Client and Coinbase Custody and forms a part of the Prime Broker Agreement between the Client and the Coinbase. Coinbase Prime holds the title of the world's biggest custodian and is responsible for safeguarding 90% of the Bitcoin that's included in ETFs. Licenses / Regulatory Compliance: Coinbase Custody is a qualified custodian and a fiduciary under New York state banking law. Insurance: Claims a $ million. Coinbase is the largest cryptocurrency custodian5 in the U.S. by assets. The customized integration between Coinbase and Aladdin® can help bring your clients. Coinbase Custody, a US-based digital asset custodian for institutions, has been added to the Polymath Service Provider Marketplace. This allows Polymath. “Coinbase Custody Trust Company, LLC is a fiduciary under § of the New York Banking Law and a qualified custodian for purposes of Rule (4)-2(d)(6) under. “capitolovo.ru,” “Coinbase,” “Coinbase Custody,” “Trust Company” and all logos related to the Custodial Services or displayed on the Trust Company. We're announcing the launch of a new company to help institutional investors securely store digital assets: Coinbase Custody. The custodianship services provided by Coinbase involve the storage and management of the cryptographic keys that control access to digital. The Responsible Entity has appointed Coinbase Custody Trust Company, LLC (“Coinbase”) as the Custodian of the Bitcoin acquired in connection with the Fund. General: Coinbase Custody Trust Company is a fiduciary under § of the New York Banking Law and a qualified custodian for purposes of Rule (4)-2(d)(6). In the course of facilitating these transactions, Coinbase serves as a custodian As Gensler noted, this risk factor applies to cryptocurrency custodians. They will also serve as custodians for 3iQ CoinShares Ether ETF (TSX: ETHQ) and the Ether Fund (TSX: QETH). 3iQ has also selected Coinbase Prime to provide. To the extent U.S. customer funds are held as cash, they are maintained in pooled custodial accounts at one or more banks insured by the FDIC. Our custodial. For proper understanding, let's begin with a definition of custodian services: In simple terms, a cryptocurrency custody service is a secure, off-chain storage.

Romantic Getaways For New Years

New Year's Eve in California: Top Accommodations ; Beautiful Vacation Home in Vintage Park East with Private Pool. Vintage Park East, Vineyard, California. For those who prefer sand over snow, head to Puerto Rico to ring in the New Year. The beachfront Condado Vanderbilt is steps from the Atlantic Ocean. The hotel. Romantic New Year's Eve Package in Lake Country · Two Candlelight Breakfasts · Complementary Snacks, Bottled Water, & Soda in Butler's Pantry · Bottle of Champagne. Nestled on acres of the Santa Ana Pueblo, between the Sandia Mountains and the Rio Grande, the lands of this resort are steeped in over one thousand years. Where to Spend New Year's Eve? Our Top 10 New Year Destinations! · 1. Best Countdown – New York City, New York · 2. · 3. · 4. · 5 – Best parties – New Orleans. Top 8 New Year's Eve Getaways in Michigan - capitolovo.ru · 1. Watch the Cherry Drop in Traverse City · 2. Take in the Lake Views of Ludington · 3. Anchors Away in. Book your romantic New Years Eve holiday getaway to our Michigan bed and breakfast with the one who matters most and spend your holiday soaking away worries. The two of you will never forget a trip to Glen-Ella Springs Inn in North Georgia. Here, we celebrate our holidays with intimate acoustic concerts and a glass. The Poconos and the Lehigh Valley are always nice. Lots to do, and plenty of nice winter hikes around waterfalls. Milford, Lake Wallenpaupack. New Year's Eve in California: Top Accommodations ; Beautiful Vacation Home in Vintage Park East with Private Pool. Vintage Park East, Vineyard, California. For those who prefer sand over snow, head to Puerto Rico to ring in the New Year. The beachfront Condado Vanderbilt is steps from the Atlantic Ocean. The hotel. Romantic New Year's Eve Package in Lake Country · Two Candlelight Breakfasts · Complementary Snacks, Bottled Water, & Soda in Butler's Pantry · Bottle of Champagne. Nestled on acres of the Santa Ana Pueblo, between the Sandia Mountains and the Rio Grande, the lands of this resort are steeped in over one thousand years. Where to Spend New Year's Eve? Our Top 10 New Year Destinations! · 1. Best Countdown – New York City, New York · 2. · 3. · 4. · 5 – Best parties – New Orleans. Top 8 New Year's Eve Getaways in Michigan - capitolovo.ru · 1. Watch the Cherry Drop in Traverse City · 2. Take in the Lake Views of Ludington · 3. Anchors Away in. Book your romantic New Years Eve holiday getaway to our Michigan bed and breakfast with the one who matters most and spend your holiday soaking away worries. The two of you will never forget a trip to Glen-Ella Springs Inn in North Georgia. Here, we celebrate our holidays with intimate acoustic concerts and a glass. The Poconos and the Lehigh Valley are always nice. Lots to do, and plenty of nice winter hikes around waterfalls. Milford, Lake Wallenpaupack.

Here are Ontario getaway packages for families, couples and singles looking to ring in the new year at popular resorts, hotels and accommodations in Ontario. Apr 27, - The best places to celebrate New Years Eve in America! Historic and romantic hotels and locations all across the United States. Romantic Getaways: The Best Honeymoon Suites in Charleston's Hotels · Sep 2, ; Ho-Ho-Hotel Happiness: Christmas Delights in Downtown. New Destinations to Know in the New Year · Virgin Hotels Edinburgh · United Kingdom · Virgin Hotels Edinburgh Edinburgh, Scotland, UK · Italy · Borgobrufa SPA Resort. Wolf Cove Inn takes a fun and festive approach to New Year's “bar hopping” with scrumptious dinner bars perfect for mingling and munching. · Madison Beach Hotel. Apr 27, - The best places to celebrate New Years Eve in America! Historic and romantic hotels and locations all across the United States. Searching for places to go for New Year's in Texas? Check out these relaxing NYE destinations in Texas for the best New Year getaways. Search for Pocono Mountains New Year's Eve special offers and discount packages on fabulous resorts, inns, and bed & breakfasts. Ring in the New Year in style with C Lazy U's famous New Year's Eve party! Suitable for families and couples, the ranch is a magical place to celebrate. Parties With a Focused on Feasting · Wolf Cove Inn takes a fun and festive approach to New Year's “bar hopping” with scrumptious dinner bars perfect for mingling. Top 8 New Year's Eve Getaways in Ohio - capitolovo.ru · 1. Cleveland · 2. Columbus · 3. Hocking Hills · 4. Dayton · 5. Akron · 6. Toledo · 7. Cincinnati · 8. Canton. Make your intimate getaway special with winter hiking, brewery visits, spa treatments, and more. New Year's Eve Train. Ring in the New Year with a ride on the. Cape Cod, Massachusetts, is one of the best places to spend New Year's on the East Coast for those searching for a romantic getaway. It's the ideal spot to ring. Black Couple Getaways presents party & hotel takeover! “Couples only” NYE party III in ATL with hotel (sold separately)! Early bird discount of $ now! A New Year's Eve getaway to New York means being treated to stunning decorations and an exciting atmosphere on every corner. Ice skate in Central Park, watch a. Some of the best places to celebrate New year's Eve are Gokarna, Andaman, Lake Pichola, Aleppey, and ofcourse, Goa. What should you not do on New Year's Day? You can also have a romantic staycation right at home! Chicago boasts so many fabulous hotels, many offering even more reasons to adore them with seasonal. If you're looking for the top Colorado vacation spots for where to spend NYE, check out these places to go for New Years in Colorado! Best NYE destinations in the U.S.: · Sanibel and Captiva Island, Florida · Austin, Texas · San Diego, California · Miami, Florida · Puerto Rico · The U.S. Virgin.

House Price Index Usa

Housing Index in the United States decreased to points in June from points in May of This page provides the latest reported value for. In most cases, the nominal house price index covers the sales of newly-built and existing dwellings, following the recommendations from the RPPI (Residential. View data of a benchmark of average single-family home prices in the U.S., calculated monthly based on changes in home prices over the prior three months. The S&P CoreLogic Case-Shiller Home Price Indices are the leading measures of US residential real estate prices, tracking changes in the value of residential. U.S. Home Prices vs. Consumer Price Index · Finally, all of the 20 markets show greater growth in home prices compared to the trend in consumer prices. That is. The ICE Home Price Index™ delivers one of the most granular and accurate measures of residential real-estate price trends in the U.S. The index measures the price change of single-family housing units that have been sold at least twice (excluding newly constructed homes). The index is produced by aggregating county-level data to create both seasonally adjusted and non-seasonally adjusted national indices that are representative. The FHFA house price index is a quarterly index that measures average changes in housing prices based on sales or refinancing's of single-family homes. Housing Index in the United States decreased to points in June from points in May of This page provides the latest reported value for. In most cases, the nominal house price index covers the sales of newly-built and existing dwellings, following the recommendations from the RPPI (Residential. View data of a benchmark of average single-family home prices in the U.S., calculated monthly based on changes in home prices over the prior three months. The S&P CoreLogic Case-Shiller Home Price Indices are the leading measures of US residential real estate prices, tracking changes in the value of residential. U.S. Home Prices vs. Consumer Price Index · Finally, all of the 20 markets show greater growth in home prices compared to the trend in consumer prices. That is. The ICE Home Price Index™ delivers one of the most granular and accurate measures of residential real-estate price trends in the U.S. The index measures the price change of single-family housing units that have been sold at least twice (excluding newly constructed homes). The index is produced by aggregating county-level data to create both seasonally adjusted and non-seasonally adjusted national indices that are representative. The FHFA house price index is a quarterly index that measures average changes in housing prices based on sales or refinancing's of single-family homes.

The average home value in United States is $, up % over the past year. Learn more about the United States housing market and real estate trends. Free economic data, indicators & statistics. United States House Price Index from ECONOMICS. Property Prices Up More Than 3% This Year Newport Beach, CA, September 6, — The Green Street Commercial Property Price Index® increased % in August. The Case-Shiller Home Price Index is the most accurate way to look at house price appreciation in a city, between cities, and nationally. OFHEO's House Price Index (HPI) is a measure designed to capture changes in the value of single-family homes in the U.S. as a whole, in various regions of. US house prices grew % YoY in Mar , following an increase of % YoY in the previous quarter. YoY growth data is updated quarterly, available from Mar. In depth view into US House Price Index MoM including historical data from to , charts and stats. Get the House Price Index (MoM) results in real time as they're announced and see the immediate global market impact. The median price of a home in the United States is currently $, Show More. Median Sale Price. A house price index (HPI) measures the price changes of residential housing as a percentage change from some specific start date Methodologies commonly used. Graph and download economic data for All-Transactions House Price Index for the United States (USSTHPI) from Q1 to Q2 about appraisers, HPI. House Price Index YoY in the United States averaged percent from until , reaching an all time high of percent in July of and a record. We select a house price index for each country that is most consistent with the quarterly U.S. house price index for existing single-family houses produced by. Case the index is generally considered the leading measure of US residential real estate prices. When inflation is high, prices as measured by the CPI increase. The FMHPI provides a measure of typical price inflation for houses within the United States. Values are calculated monthly and released at the end of the. The First American Real House Price Index (RHPI) measures the price changes of single-family properties throughout the U.S. adjusted for the impact of. The House Price Index measures the movement of single-family home prices in the United States. It is reported monthly and measures the change from the previous. The FHFA House Price Index (HPI) is a broad measure of the movement of single-family house prices. The HPI is a weighted, repeat-sales index. CoreLogic's monthly Home Price Index (HPI) provides current information on home price growth trends on national, state and metro area levels. U.S. House Price Index Yearly Growth. Our house price index heat map shows the average housing price increase or decrease for each state in the U.S. Hovering.

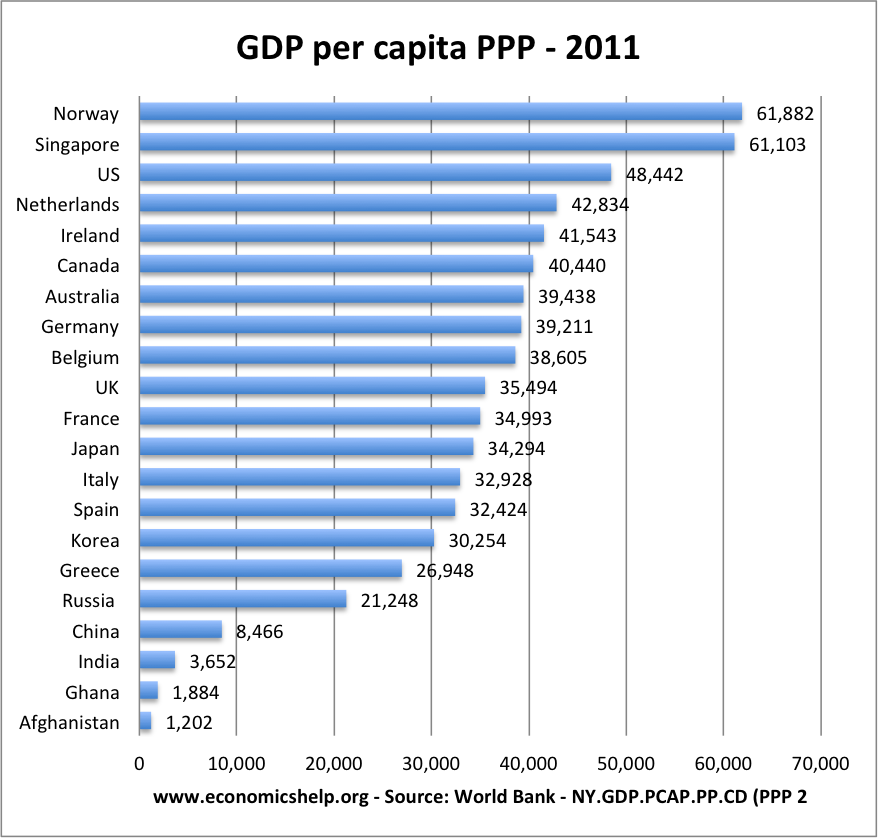

Gdp Per Capita

Real GDP per capita ; 1, Luxembourg, $, ; 2, Singapore, $, ; 3, Monaco, $, ; 4, Ireland, $, Explore the data. View figures for. GDP in PPP GDP in MER GDP per capita. Population. Please select up to six countries to view. Argentina; Australia. Gross Domestic Product (GDP) per capita shows a country's GDP divided by its total population. The table below lists countries in the world ranked by GDP at. Real GDP per capita (Multiple positions) | Unit of measure: Chain linked volumes (), euro per capita. Real GDP per capita (online data code: sdg_08_ Gross Domestic Product (GDP) per capita shows a country's GDP divided by its total population. The table below lists countries in the world ranked by GDP at. GDP per capita, purchasing power parity (PPP) (current international $) - This is the GDP divided by the midyear population, where GDP is the total value of. U.S. dollars per capita · United States. thousand · Germany. thousand. Gross Domestic Product (GDP) per capita is a core indicator of economic performance and commonly used as a broad measure of average living standards or. GDP per capita measures the total economic output of a country divided by its population, reflecting overall economic activity. Income per capita specifically. Real GDP per capita ; 1, Luxembourg, $, ; 2, Singapore, $, ; 3, Monaco, $, ; 4, Ireland, $, Explore the data. View figures for. GDP in PPP GDP in MER GDP per capita. Population. Please select up to six countries to view. Argentina; Australia. Gross Domestic Product (GDP) per capita shows a country's GDP divided by its total population. The table below lists countries in the world ranked by GDP at. Real GDP per capita (Multiple positions) | Unit of measure: Chain linked volumes (), euro per capita. Real GDP per capita (online data code: sdg_08_ Gross Domestic Product (GDP) per capita shows a country's GDP divided by its total population. The table below lists countries in the world ranked by GDP at. GDP per capita, purchasing power parity (PPP) (current international $) - This is the GDP divided by the midyear population, where GDP is the total value of. U.S. dollars per capita · United States. thousand · Germany. thousand. Gross Domestic Product (GDP) per capita is a core indicator of economic performance and commonly used as a broad measure of average living standards or. GDP per capita measures the total economic output of a country divided by its population, reflecting overall economic activity. Income per capita specifically.

The ratio of GDP to the total population of the region is the GDP per capita and can approximate a concept of a standard of living. Total GDP can also be. Gross domestic product (Average) per head, CVM market prices: SA. Source dataset: GDP first quarterly estimate time series (PN2). View other variations of this. Measuring things in per capita terms or divide real GDP at time t t by the number of people at time t t. It will be common for us to use lower-case letters. GDP per capita is often considered an indicator of a country's standard of living; however, this is inaccurate because GDP per capita is not a measure of. GDP per capita is the sum of gross value added by all resident producers in the economy plus any product taxes (less subsidies) not included in the valuation. GDP per capita (current US$) World Bank national accounts data, and OECD National Accounts data files. License: CC BY After adjusting for purchasing power the United States GDP per inhabitant totaled 63, international US dollar (int. US$) in According to IMF estimates. The Gross Domestic Product per capita in the United States was last recorded at US dollars in The GDP per Capita in the United States is. Per Capita. State. Real GDP Per Capita. Handout #2. 1. New York. $73, 18 Virginia. $55, 35 North Carolina. $47, 2. Massachusetts. $72, GDP per capita (PPP based) is gross domestic product converted to international dollars using purchasing power parity rates and divided by total population. U.S. dollars per capita · Emerging market and developing economies. thousand · Advanced economies. thousand · World. thousand. Graph and download economic data for Real gross domestic product per capita (ARX0QSBEA) from Q1 to Q2 about per capita, real, GDP, and USA. Graph and download economic data for Constant GDP per capita for China (NYGDPPCAPKDCHN) from to about China, per capita, real, and GDP. Countries in the world ranked by Gross Domestic Product (GDP). List and ranking of GDP growth, GDP per capita and couuntry share of World's GDP. GDP per capita is gross domestic product divided by midyear population. GDP is the sum of gross value added by all resident producers in the economy plus. This indicator is measured in US dollars and US dollars per capita (current PPPs). Tags. Economy · Economic Outlook · Economic surveillance. GDP per capita measures the value of everything produced in a country during a year, divided by the number of people. The unit is in international dollars. The table below is an imperfect attempt at assessing both country Income per capita levels (proxied as World Economics GDP per capita) and Asset wealth per. The Gross Domestic Product per capita in the United States was last recorded at US dollars in , when adjusted by purchasing power parity (PPP). Which country has the largest GDP per capita? Monaco has the highest GDP per capita with a GDP per capita of $, in US dollars. Frequently.