capitolovo.ru

Tools

Lowest Housing Cost In Usa

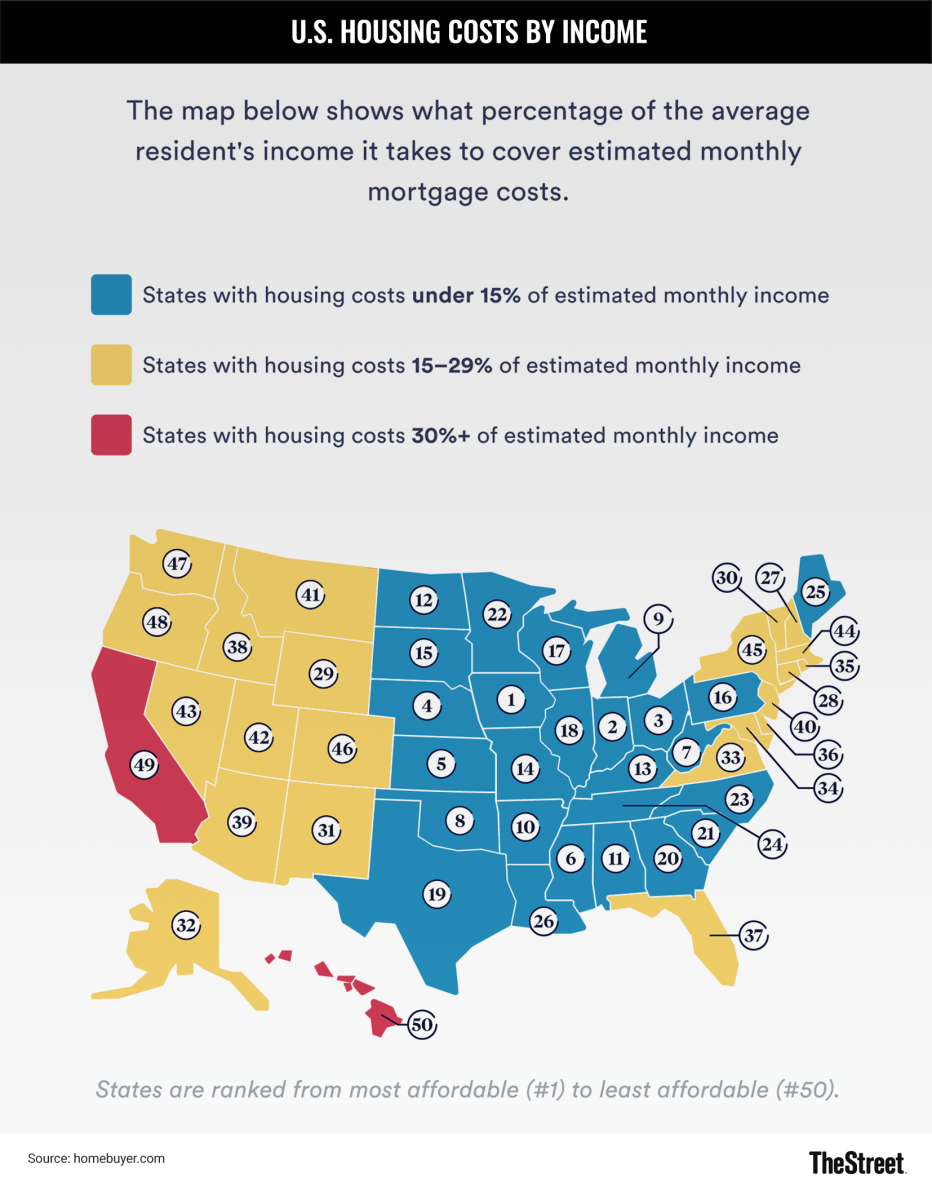

Complete List of Cheapest States to Live in America in ; 1, Mississippi, ; 2, Oklahoma, 86 ; 3, Kansas, ; 4, Missouri, Can you retire to a place that's both affordable and fun? We found out. · 1. Decatur, Alabama. Cost of living for retirees: % below U.S. average · 2. Prescott. Arkansas #1 in Affordability #47 in Best States Overall #29 in Opportunity Bordered by Missouri, Tennessee, Mississippi, Louisiana, Texas and Oklahoma. In the Phoenix area, Scottsdale, Glendale, Mesa, Chandler, and Phoenix itself are all among the most affordable cities for U.S. renters. 2. Plano, Texas. Source(s): U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price of Houses Sold for the United States (MSPUS), retrieved. low housing cost adjustments. Also, the two sets of area definitions are The Low-Income Housing Tax Credit program is a U.S. Treasury Department. The rental housing conditions in Denver are largely representative of other US cities. Uses. Buildings cost money to build: to developers, those costs are often. The cheapest state in America is Mississippi, where cost of living is 21% lower than US avg. Food and housing in Vietnam are around two-thirds cheaper than. Mississippi has the lowest cost of living in the US, with a cost of living index of Most notably, Mississippi's housing index is , the lowest in the. Complete List of Cheapest States to Live in America in ; 1, Mississippi, ; 2, Oklahoma, 86 ; 3, Kansas, ; 4, Missouri, Can you retire to a place that's both affordable and fun? We found out. · 1. Decatur, Alabama. Cost of living for retirees: % below U.S. average · 2. Prescott. Arkansas #1 in Affordability #47 in Best States Overall #29 in Opportunity Bordered by Missouri, Tennessee, Mississippi, Louisiana, Texas and Oklahoma. In the Phoenix area, Scottsdale, Glendale, Mesa, Chandler, and Phoenix itself are all among the most affordable cities for U.S. renters. 2. Plano, Texas. Source(s): U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price of Houses Sold for the United States (MSPUS), retrieved. low housing cost adjustments. Also, the two sets of area definitions are The Low-Income Housing Tax Credit program is a U.S. Treasury Department. The rental housing conditions in Denver are largely representative of other US cities. Uses. Buildings cost money to build: to developers, those costs are often. The cheapest state in America is Mississippi, where cost of living is 21% lower than US avg. Food and housing in Vietnam are around two-thirds cheaper than. Mississippi has the lowest cost of living in the US, with a cost of living index of Most notably, Mississippi's housing index is , the lowest in the.

Wondering how competitive the U.S. housing market is? Find the median U.S. house price, housing demand, supply and real estate trends with Redfin. United States. Yearly Quarterly. Q Definition. Housing prices include housing rent prices indices, real and nominal house prices indices, and ratios. Many of these housing types have a smaller footprint, which helps to keep construction costs low. United States with case studies and links to projects. In South America, Santiago is famous for its affordable low cost of living with affordable housing options, though prices have been increasing. Missouri had the seventh lowest cost of living in the United States for the second quarter in In general, the most expensive areas to live were Hawaii. Learn about government programs that help people with low incomes find affordable rental housing. Ask capitolovo.ru a question at. USAGOV1 ( How Much Do You Need to Earn to Afford a Modest Apartment in Your State? · Arizona · North Dakota · Iowa · Washington · Nevada · Florida · South Dakota · Michigan. Cost of Home affordable enables communities to thrive. Database Families across the United States are paying too high a price to cover the cost of home. Low-income CHI is calculated to examine the cost of housing for people earning 50% of the area's median income. CHI Key Findings in Q2 CHI results for the. This city in North Carolina is another one of the most affordable and safest places to live in the USA. The cost of living here is cheap and it is one of the. Affordable Housing: Affordable housing is generally defined as housing on which the occupant is paying no more than 30 percent of gross income for housing costs. 10 Countries with the lowest cost of living in the world The countries where locals spend the least on everyday living are Pakistan, Egypt, Nepal, Bhutan, and. How Much Do You Need to Earn to Afford a Modest Apartment in Your State? · Arizona · North Dakota · Iowa · Washington · Nevada · Florida · South Dakota · Michigan. New research shows that just building new housing—even expensive housing—can quickly drive down housing costs across metro areas, including in low-income. The federal government typically defines housing as affordable when it consumes no more than 30 percent of a household's income. So, who needs affordable. United States– more than half of low-income tenant households are overburdened by the cost of housing. Meanwhile, on average, more than one in four low. low housing cost adjustments. Also, the two sets of area definitions are The Low-Income Housing Tax Credit program is a U.S. Treasury Department. San Jose was the least affordable major US housing market in , with a median boundaries alone add a staggering NZ$, (US$,) to the cost of land. The U.S Department of Housing and Urban Development (HUD) considers housing The cost of affordable housing: Does it pencil out? Urban Institute · National.

Easiest Place To Get Mortgage Loan

An FHA loan will typically be the easiest mortgage to qualify for because it offers the lowest credit score requirement — far lower than for a conventional loan. Your best bet is to go to a mortgage broker or lender and have him qualify you. You will save yourself and you real estate agent a lot of time. Go to a mortgage broker, a traditional bank, and an online bank. Shop around and get them to drive eachother down. In My experience the broker. FHA - FHA mortgages are commonly used with first-time homebuyers because of the lenient FICO score guidelines that allows borrowers with a weaker credit history. way of homeownership. Our % financing fixed-rate mortgage Our personal loan advisor will make your home buying experience easy and stress-free. These SBA-backed loans make it easier for small businesses to get the funding they need. US country outline with flag. The business is physically. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United. Buying a home in a rural area? You may be able to qualify for a % financing loan through the USDA Rural Housing program. This type of loan, like a VA Loan. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. An FHA loan will typically be the easiest mortgage to qualify for because it offers the lowest credit score requirement — far lower than for a conventional loan. Your best bet is to go to a mortgage broker or lender and have him qualify you. You will save yourself and you real estate agent a lot of time. Go to a mortgage broker, a traditional bank, and an online bank. Shop around and get them to drive eachother down. In My experience the broker. FHA - FHA mortgages are commonly used with first-time homebuyers because of the lenient FICO score guidelines that allows borrowers with a weaker credit history. way of homeownership. Our % financing fixed-rate mortgage Our personal loan advisor will make your home buying experience easy and stress-free. These SBA-backed loans make it easier for small businesses to get the funding they need. US country outline with flag. The business is physically. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United. Buying a home in a rural area? You may be able to qualify for a % financing loan through the USDA Rural Housing program. This type of loan, like a VA Loan. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave.

That's why we're here. We'll guide you every step of the way. Variety of mortgage loans. and exclusive programs that make the process easy and quick. Lendio earned our pick as the best for commercial property loans because its marketplace platform is the easiest way for an investor to fill out one application. Friendly financing. Sure, it means that our professional lenders will help you every step of the way. But it also means that you get a loan that's easy to live. Explore competitive rates on Navy Federal Credit Union mortgage loans and learn more about available options for making your dream home a reality. Get. The 10 best mortgage lenders of August — and how to get their lowest rates · Guaranteed Rate · Pennymac · Bank of America · Alliant Credit Union · Wells Fargo. These loans are backed by the government and are designed to help make homeownership more affordable and accessible to a wider range of people. While a %. USDA rural development loans are available to homebuyers seeking to purchase in a rural location. mortgage process, ensuring your arrival at "the easiest way. At Freedom Mortgage, we help FHA homeowners refinance with an easy credit qualification. You will need to meet our financial requirements to get your refinance. One point equals one percent of the loan amount (for example, 2 points on Apply for financing and get the mortgage that meets your needs. I already. We make getting a mortgage easier. Our online process is streamlined to get you into your home sooner! Contact us today. The minimum credit score needed to get an FHA loan through most lenders, including Rocket Mortgage®, is A few lenders do offer FHA loans with a minimum. Visit Wells Fargo today to check rates and get mortgage financing I have done several mortgages and this by far was the easiest." Kenneth F. . That all takes place before you get to one of the trickiest parts of all: mortgage loans. It is easy for people to assume banks are the best option as they seem. a better deal. Low down payments Low closing costs Easy credit qualifying What does FHA have for you? Buying your first home? FHA might be just what you need. PNC is one of the best mortgage lenders, thanks in large part to their combination of a sophisticated website blended with mortgage loan officers operating. The more knowledgeable you are before you approach lenders, the better deal you're likely to get. Look in your local paper to see what rates are being offered. A mortgage designed for you. We make buying a home as easy and affordable as possible. With an average turnaround of 30 days, we get you in the door sooner. Apply Find a Mortgage Loan Officer. Every home is unique, so why It's another way that Truliant works to make the home buying process easier for you. Same Day Mortgage removes the uncertainty from buying a home. Get your loan approved in one day with options as little as 3% down. Through Section (h), the Federal Government helps survivors in presidentially-designated disaster areas recover by making it easier for them to get mortgages.

Defrauding Investors Is Another Way To Describe

A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi schemes are named after Charles Ponzi. investment fraud. How can I recognise a scam? A scammer's or fraudster's aim is to mislead you and obtain your money. In order to achieve their goal, they. A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organizers often promise to invest. Securities, commodities, and investment fraud;; Investment advisor fraud,; Market manipulation;; Schemes to defraud or deceive;; Ponzi and pyramid schemes;. another term of art—“clawback”—a shorthand term for a legal theory under which defrauded investors not only suf- fer the loss of what they invested with the. Businesses and individuals should take care not to fall victim to investment scams, which are commonly known as Advance Fee Fraud schemes. Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make. a person or business that is defrauding investors or illegally issuing securities; or; a person or business who offers you confidential information or “insider”. Investment fraud happens when people try to trick you into investing money. They might want you to invest money in stocks, bonds, notes, commodities, currency. A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi schemes are named after Charles Ponzi. investment fraud. How can I recognise a scam? A scammer's or fraudster's aim is to mislead you and obtain your money. In order to achieve their goal, they. A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organizers often promise to invest. Securities, commodities, and investment fraud;; Investment advisor fraud,; Market manipulation;; Schemes to defraud or deceive;; Ponzi and pyramid schemes;. another term of art—“clawback”—a shorthand term for a legal theory under which defrauded investors not only suf- fer the loss of what they invested with the. Businesses and individuals should take care not to fall victim to investment scams, which are commonly known as Advance Fee Fraud schemes. Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make. a person or business that is defrauding investors or illegally issuing securities; or; a person or business who offers you confidential information or “insider”. Investment fraud happens when people try to trick you into investing money. They might want you to invest money in stocks, bonds, notes, commodities, currency.

This is an investment fraud where there is no actual investment. Money from new investors is used to pay existing investors to make it appear that money is. This can be done through a variety of methods such as identity theft or investment fraud. For all types of financial fraud, it is important to report the crimes. How To File Your Form SIPC-3 · Portal Information. Information about the SIPC Fraud Alerts: See our latest fraud alerts to protect yourself. Click. If you cannot explain the investment opportunity in a few words and in an understandable way, you may need to reconsider the potential investment. Before. A Ponzi scheme is an investment scam that pays early investors with money taken from later investors to create an illusion of big profits. The scammers solicit investments into non-existent managed funds and are not in any way affiliated with Blackstone. The only app authorized by Blackstone is. Possible motivations for misrepresentation of the loan purpose are to purchase investment property with more favorable loan rates than would be available if a. A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors Learn how to form a saving and investing. Profitability or trend level expectations of investment analysts, institutional investors definition of fraud or other reason to prefer alternative terms. Complain to the Securities and Exchange Commission (SEC) about investments. Read about the types of complaints they handle and the complaint process. Use the. A standard Ponzi scheme is a fraudulent investment scheme in which an operator pays returns on investments from capital derived from new investors. A Ponzi scheme is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Fraud becomes a crime when it is a “knowing misrepresentation of the truth or concealment of a material fact to induce another to act to his or her detriment” . " The initial promoters recruit investors, who in turn recruit more investors, and so on. The easiest way to avoid being defrauded is obviously not to. Get a second opinion from a trusted adviser, family member, or friend before making an investment. Seeking advice from someone you know and trust is good way to. Beyond prevalence rates, another way to think related to financial fraud victimization, another factor may also help explain the likelihood of being. Ponzi schemes are a type of investment fraud in which investors are promised artificially high rates of return with little or no risk. If your case isn't legally, factually, or financially justified, we'll carefully explain how you were defrauded. You don't just get a lawyer; you get our. It's simple: Click the button below and type the name of the company or person you're looking to invest with to see if they are registered to sell investments. Fake websites (e.g., fund comparison websites) to obtain personal information which is then used to make contact to offer an allegedly attractive investment.

What Is A 5 Year Balloon Payment

With most balloon payment terms ranging up to 5 years, this gives plenty of time for most buyers to refinance into a bank loan such as an FHA or conventional. A balloon loan is a type of loan that has a relatively short term with small regular payments and a large final payment at the end of the term. For a UK. That said, the payment structure for a balloon loan is very different from a traditional loan. At the end of the five to seven-year term, the borrower has paid. This kind of financing is typically taken out for years and necessitates regular payments throughout the duration. When the term ends, the remainder should. How exactly do balloon payments work? While some balloon mortgages come with 3- to 5-year terms, HELOCs generally come with a year term. Either way, the. If you take a balloon mortgage of $, to finance your home with a five year term and % interest rate, your monthly payment for five years will be $. A balloon payment is a lump sum principal balance that is due at the end of a loan term. The borrower pays much smaller monthly payments until the balloon. We reached out to the seller for a potential seller financing offer and he came back with these terms M Purchase 20% Down 30 Year % Interest 5 Year. A balloon mortgage has fixed monthly payments, but you'll owe most of your principal at the end of the loan in the form of a balloon payment. Learn more about. With most balloon payment terms ranging up to 5 years, this gives plenty of time for most buyers to refinance into a bank loan such as an FHA or conventional. A balloon loan is a type of loan that has a relatively short term with small regular payments and a large final payment at the end of the term. For a UK. That said, the payment structure for a balloon loan is very different from a traditional loan. At the end of the five to seven-year term, the borrower has paid. This kind of financing is typically taken out for years and necessitates regular payments throughout the duration. When the term ends, the remainder should. How exactly do balloon payments work? While some balloon mortgages come with 3- to 5-year terms, HELOCs generally come with a year term. Either way, the. If you take a balloon mortgage of $, to finance your home with a five year term and % interest rate, your monthly payment for five years will be $. A balloon payment is a lump sum principal balance that is due at the end of a loan term. The borrower pays much smaller monthly payments until the balloon. We reached out to the seller for a potential seller financing offer and he came back with these terms M Purchase 20% Down 30 Year % Interest 5 Year. A balloon mortgage has fixed monthly payments, but you'll owe most of your principal at the end of the loan in the form of a balloon payment. Learn more about.

The time period after which you must refinance or pay off your loan. The most common balloon loan terms are 3 years and 5 years. After the loan term is complete. A balloon loan is a short-term mortgage, often lasting between 5 and 7 years, but with a payment plan typically based on a 15 or year mortgage. At the end of. Suppose a borrower takes out a $, balloon loan with a 10% interest rate and a 5-year term. The borrower agrees to pay $10, of interest each year for. However, this 30/5 has a balloon payment of $72, due in 60 months. If the borrower is unable to refinance, they must be able to come up with the cash for the. The term of a balloon mortgage is usually short (e.g., 5 years), but the payment amount is amortized over a longer term (e.g., 30 years). An advantage of. A balloon mortgage is one in which the borrower makes relatively low payments for an initial period of time (5, 7, or 15 years) before one very large mortgage “. But lenders often calculate monthly payments as though the loan is a traditional year mortgage, making the monthly payment smaller. Payments can also cover. Balloon payments are a loan feature frequently found in commercial and residential mortgages. For home loans, they usually come in short terms of 5 to 10 years. A balloon mortgage is a loan that's paid off with a lump sum at the end of the term. In most cases, borrowers are only responsible for the interest until. What is a Balloon Payment? A balloon payment is when you have to make a one-time payment on your loan before the maturity date. A balloon mortgage has fixed monthly payments, but you'll owe most of your principal at the end of the loan in the form of a balloon payment. Learn more about. The payments are calculated in exactly the same way. In both cases, the payment is the amount required to pay off the mortgage in full over 30 years. Where the. A balloon payment can be part of a loan with both fixed or variable interest rates, and is commonly repaid over a period of years for commercial loans. The term of a balloon mortgage is usually short (e.g., 5 years), but the payment amount is amortized over a longer term (e.g., 30 years). An advantage of. A balloon payment, simply put, is a large payment that is due at the end of a loan term. It is different from a fully amortized loan, where a loan is paid. A balloon payment mortgage is a mortgage that does not fully amortize over the term of the note, thus leaving a balance due at maturity. The final payment is. The term of a balloon mortgage is usually short (e.g., 5 years), but the payment amount is amortized over a longer term (e.g., 30 years). An advantage of. A Fixed Rate 5 Year Balloon can be used to purchase or refinance a primary, secondary or investment family dwelling. This loan will be amortized over Most balloon loans are typically for a 5 or 10 year repayment period with a 30 year amortization term. It is the 30 years which you would enter below. If you. The monthly payment is based on a 30 year loan. When you solve for the Balloon Only payment, fill in the first FOUR fields and then press the Balloon Only.

Pampers Company Stock

In depth view into PG (Procter & Gamble) stock including the latest price, news, dividend history, earnings information and financials. View Procter & Gamble Company PG stock quote prices, financial information The Baby, Feminine and Family Care segment sells baby wipes, diapers. Learn the basics about the P&G company's stock information: current data and history of changes. Get more information for investors and stakeholders. The company's shares traded at over $86 per share in , and its market Pampers baby product line's former sub-brand, Kandoo. With Walmart, PGP. The company employs approximately , people worldwide and has a market In the global baby care market, P&G's Pampers brand is a market leader, competing. Victor Mills was an American chemical engineer who, while working for the Procter & Gamble Co The only problem was that no one knew exactly where to stock. Discover real-time Procter & Gamble Company (The) Common Stock (PG) stock prices, quotes, historical data, news, and Insights for informed trading and. Procter & Gamble Company (The) Common Stock (PG). 1D. 5D. 1M. 6M. YTD. 1Y. 5Y. MAX Pamper s diapers. P&G sold its last remaining food brand, Pringles, to. PG stock price today for Procter & Gamble NYSE: PG stock rating, plus other valuable data points like stock ratings, day range, year, stock analyst insights. In depth view into PG (Procter & Gamble) stock including the latest price, news, dividend history, earnings information and financials. View Procter & Gamble Company PG stock quote prices, financial information The Baby, Feminine and Family Care segment sells baby wipes, diapers. Learn the basics about the P&G company's stock information: current data and history of changes. Get more information for investors and stakeholders. The company's shares traded at over $86 per share in , and its market Pampers baby product line's former sub-brand, Kandoo. With Walmart, PGP. The company employs approximately , people worldwide and has a market In the global baby care market, P&G's Pampers brand is a market leader, competing. Victor Mills was an American chemical engineer who, while working for the Procter & Gamble Co The only problem was that no one knew exactly where to stock. Discover real-time Procter & Gamble Company (The) Common Stock (PG) stock prices, quotes, historical data, news, and Insights for informed trading and. Procter & Gamble Company (The) Common Stock (PG). 1D. 5D. 1M. 6M. YTD. 1Y. 5Y. MAX Pamper s diapers. P&G sold its last remaining food brand, Pringles, to. PG stock price today for Procter & Gamble NYSE: PG stock rating, plus other valuable data points like stock ratings, day range, year, stock analyst insights.

Market Capitalization >; ROE> View More Stocks. 5X Premium to Book Value. Companies trading at more than 5 times their book values. PB, BV, Industry PB. The Baby, Feminine and Family Care segment sells baby wipes, diapers This is derived by dividing a company's stock price by its total stockholders' equity (or. Some of the popular brands owned by the company include Head & Shoulders, Pantene, Olay, Gillette, Oral-B, Vicks, Ariel, Tide, Pampers, Luvs and Bounty. The. Get Procter & Gamble Company (PG) share price today, stock analysis, stock Pampers brands; adult incontinence and feminine care products under the. Key Stats · Market CapB · Shares OutB · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change company stock and sold $63,, in company stock. The Baby, Feminine & Family Care segment includes brands such as Pampers, Always, and Tampax. Procter & Gamble Company (capitolovo.ru): Stock quote, stock chart, quotes Pampers), toilet papers and paper towels (Bounty, Charmin, Puffs), feminine. Real time Procter & Gamble (PG) stock price quote, stock graph, news & analysis. Business Description. capitolovo.ru STOCK LIST USA NYSE Procter & Gamble Co Pampers diapers. Sales outside its home turf represent more than half of the. Pampers diapers, and Gillette razors. Performance In the last 1 year, Coca-cola Company, The has given % return, outperforming this stock by %. The Procter & Gamble Company stock price today is What Is the Stock Symbol for Procter & Gamble Company? The stock ticker symbol for Procter & Gamble. Historical daily share price chart and data for Procter & Gamble since adjusted for splits and dividends. Learn about our Investor Relations and find relevant information about investing shares and bonds. Delivering long-term investor returns with P&G. Shares of Procter & Gamble (PG) tumbled Tuesday when the consumer products giant missed revenue estimates as sales of its beauty products and diapers declined. This includes diapers, wipes and etc. Pampers. Pampers products. Company type, Subsidiary. Founded, February. How P&G Recovered from Pampers Fail in Japan. 12/28/ Rookie mistakes may be common, but some are more costly than others. You know it's bad when a corporate. Clean, and Swiffer brands. The Baby, Feminine & Family Care segment offers baby wipes, and taped diapers and pants under the Luvs and Pampers brands; adult. Pampers diapers. Sales outside its home turf represent more than half of the Procter & Gamble Company trades on the NYSE stock market under the symbol PG. P&G Share Price - Get P&G Ltd LIVE BSE/NSE stock price with Performance, Fundamentals, Market Cap, Share holding, financial report, company profile. Get the latest Procter & Gamble Company (The) (PG) stock price, news Pricing power helped Procter & Gamble, which makes Tide, Pampers and Bounty.

Buy Or Sell Puts

When you buy a put option, you're buying the right to sell someone a specific security at a locked-in strike price sometime in the future. If the price of. Income Strategy: Selling put options allows investors to earn income by obligating them to buy stocks at a predetermined price if the stock falls below that. A put option is an option contract that gives the buyer the right, but not the obligation, to sell the underlying security at a specified price. Income Strategy: Selling put options allows investors to earn income by obligating them to buy stocks at a predetermined price if the stock falls below that. If you buy an option to buy futures, you own a call option. If you buy an option to sell futures, you own a put option. Call and put options are separate. A long put is a single-leg, risk-defined, bearish options strategy. Buying a put option is a levered alternative to short selling stock. A put option is a contract that gives the owner the right, without any obligation, to sell the equivalent of shares of an underlying asset at a. Investors who sell a put are obligated to purchase the underlying stock if the buyer decides to exercise the option. An investor who sells a put may also be. The intent of selling puts is the same as that of selling calls; the goal is for the options to expire worthless. The strategy of selling uncovered puts, more. When you buy a put option, you're buying the right to sell someone a specific security at a locked-in strike price sometime in the future. If the price of. Income Strategy: Selling put options allows investors to earn income by obligating them to buy stocks at a predetermined price if the stock falls below that. A put option is an option contract that gives the buyer the right, but not the obligation, to sell the underlying security at a specified price. Income Strategy: Selling put options allows investors to earn income by obligating them to buy stocks at a predetermined price if the stock falls below that. If you buy an option to buy futures, you own a call option. If you buy an option to sell futures, you own a put option. Call and put options are separate. A long put is a single-leg, risk-defined, bearish options strategy. Buying a put option is a levered alternative to short selling stock. A put option is a contract that gives the owner the right, without any obligation, to sell the equivalent of shares of an underlying asset at a. Investors who sell a put are obligated to purchase the underlying stock if the buyer decides to exercise the option. An investor who sells a put may also be. The intent of selling puts is the same as that of selling calls; the goal is for the options to expire worthless. The strategy of selling uncovered puts, more.

This options trading strategy allows traders to purchase the right to sell shares of a stock at a predetermined price within a specific time frame. Investors buy puts when they believe the price of the underlying asset will decrease and sell puts if they believe it will increase. Payoffs for Options: Calls. Investors buy puts when they believe the price of the underlying asset will decrease and sell puts if they believe it will increase. Payoffs for Options: Calls. But there are other ways to put money behind the movements of a stock price. Investors can also buy and sell options, which are a kind of contract that allows. Selling puts is a great way to generate income and acquire shares of capitolovo.ruer some of the most common mistakes when selling puts and how avoid them. At the time of taking the decision, if the call option has a low premium then buying a call option makes sense, likewise if the put option is trading at a very. Short selling is pretty straightforward, so it is relatively easier to effectively start short selling than it is to start buying puts. Learning how to trade. Selling puts and buying calls are two different fundamental options strategies, each having distinct mechanisms and outcomes. A covered put implies selling a put against an existing round lot of short stock previously established in your portfolio. When an investor sells a put against. Selling puts. Selling covered puts involves the simultaneous selling of stock and a put option. In this, the view is bearish and the stock price is expected to. Simply put (pun intended), a put option is a contract that gives the option buyer the right — but not the obligation — to sell a particular underlying security. The buyer of options has the right, but not the obligation, to buy or sell an underlying security at a specified strike price, while a seller is obligated to. Speculation – Buy calls or sell puts: Traders can speculate on the price movement of an underlying asset by buying call options or selling put options. This. A put option gives the contract owner/holder (the buyer of the put option) the right to sell the underlying stock at a specified strike price by the expiration. When you sell a put, you have agreed to buy a stock or index at an agreed price (strike). If the price rises, you can pocket the premium received. Opposite, if. When you buy a put option, you enter a contract that allows you to sell shares (typically) of stock on or before a chosen date at a predetermined price. When an investor goes short a put, they are bullish on the underlying security's market price. Selling a put obligates the investor to buy stock at the. Investors who sell a put are obligated to purchase the underlying stock if the buyer decides to exercise the option. An investor who sells a put may also be. If you buy an option to buy futures, you own a call option. If you buy an option to sell futures, you own a put option. Call and put options are separate. Essentially, when you're buying a put option, you are “putting” the obligation to buy the shares of a security you're selling with your put on the other party.

What Is A Wifi Provider

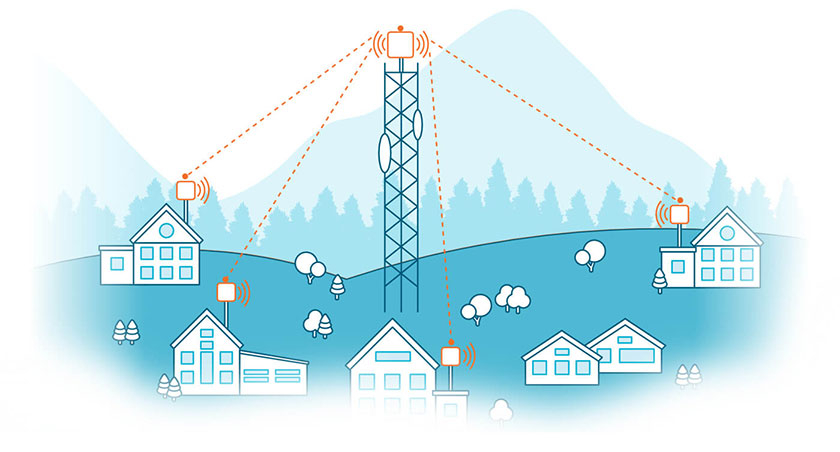

An ISP (internet service provider) is a company that provides individuals and organizations access to the internet and other related services. An ISP has the. An Internet Service Provider (ISP) is a company that provides Internet access to organizations and home users. Your Internet Service Provider (ISP) is the company that provides your internet access. Examples of ISPs are: Visit capitolovo.ru to look for your ISP. In order to use eero, you will still need to have an Internet Service Provider (ISP). eero works with all ISPs in the United States and. Internet service providers (ISP) are responsible for making internet service in the home popular and accessible. Home Wi-Fi through an internet provider available to you provides your household with the internet connection you need to wirelessly connect all of your devices. An ISP, or internet service provider, is a company that lets you access the internet from home, usually with a monthly subscription. ISP (Internet Service Providers) provide you with a connection that connects you with the rest of the world. Routers (and other devices) from a. A company that provides Internet access to its customers. The majority of ISPs are too small to purchase access directly from the network access point (NAP). An ISP (internet service provider) is a company that provides individuals and organizations access to the internet and other related services. An ISP has the. An Internet Service Provider (ISP) is a company that provides Internet access to organizations and home users. Your Internet Service Provider (ISP) is the company that provides your internet access. Examples of ISPs are: Visit capitolovo.ru to look for your ISP. In order to use eero, you will still need to have an Internet Service Provider (ISP). eero works with all ISPs in the United States and. Internet service providers (ISP) are responsible for making internet service in the home popular and accessible. Home Wi-Fi through an internet provider available to you provides your household with the internet connection you need to wirelessly connect all of your devices. An ISP, or internet service provider, is a company that lets you access the internet from home, usually with a monthly subscription. ISP (Internet Service Providers) provide you with a connection that connects you with the rest of the world. Routers (and other devices) from a. A company that provides Internet access to its customers. The majority of ISPs are too small to purchase access directly from the network access point (NAP).

What's the best internet service provider for you? CNET has you covered. We review the top ISPs based on the best deals, fastest speeds and more. A practical guide to starting your own Internet Service Provider. BroadbandNow: The easiest place to research, compare, and shop for internet service in your neighborhood. Becoming an Internet Service Provider (ISP) is a rewarding task, but starting up a new service takes plenty of dedication. The biggest obstacle is the. An Internet service provider (ISP) is an organization that provides myriad services related to accessing, using, managing, or participating in the Internet. A cable modem connects to the TV cable jack in your home and provides internet service to your home network from a cable ISP like Comcast Xfinity or Charter. Find your Internet Service Provider (ISP) with this online ISP lookup tool. Also check your hostname, IP address and IP location. A practical guide to starting your own Internet Service Provider. What's the best internet service provider for you? CNET has you covered. We review the top ISPs based on the best deals, fastest speeds and more. Yes, you need an internet service provider to use WiFi. WiFi is a wireless technology that enables devices to connect to the internet, but it. Our ratings of best internet providers help you find the best ISPs in your area. We also rate and review the fastest and the cheapest internet plans. The acronym ISP refers to an internet service provider, or company that provides other companies, families, and mobile users with access to the internet. The acronym ISP refers to an internet service provider, or company that provides other companies, families, and mobile users with access to the internet. A cable modem connects to the TV cable jack in your home and provides internet service to your home network from a cable ISP like Comcast Xfinity or Charter. How to start an ISP. Your best option for an ISP start-up is to create a regional wireless internet service provider, also known as a WISP. These types of. Different types of ISP connections · DSL (digital subscriber line) · cable broadband · fibre optic broadband · wireless or Wi-Fi broadband · satellite and. The typical zip code search result lists several Wi-Fi providers offering different types of connections. The most common are cable and DSL, while fiber. Get reliable, fast, and safe Internet service from AT&T, your local Internet Service Provider (ISP). View Internet plans, prices and offers in your area! ISP (Internet Service Providers) provide you with a connection that connects you with the rest of the world. Routers (and other devices) from a.

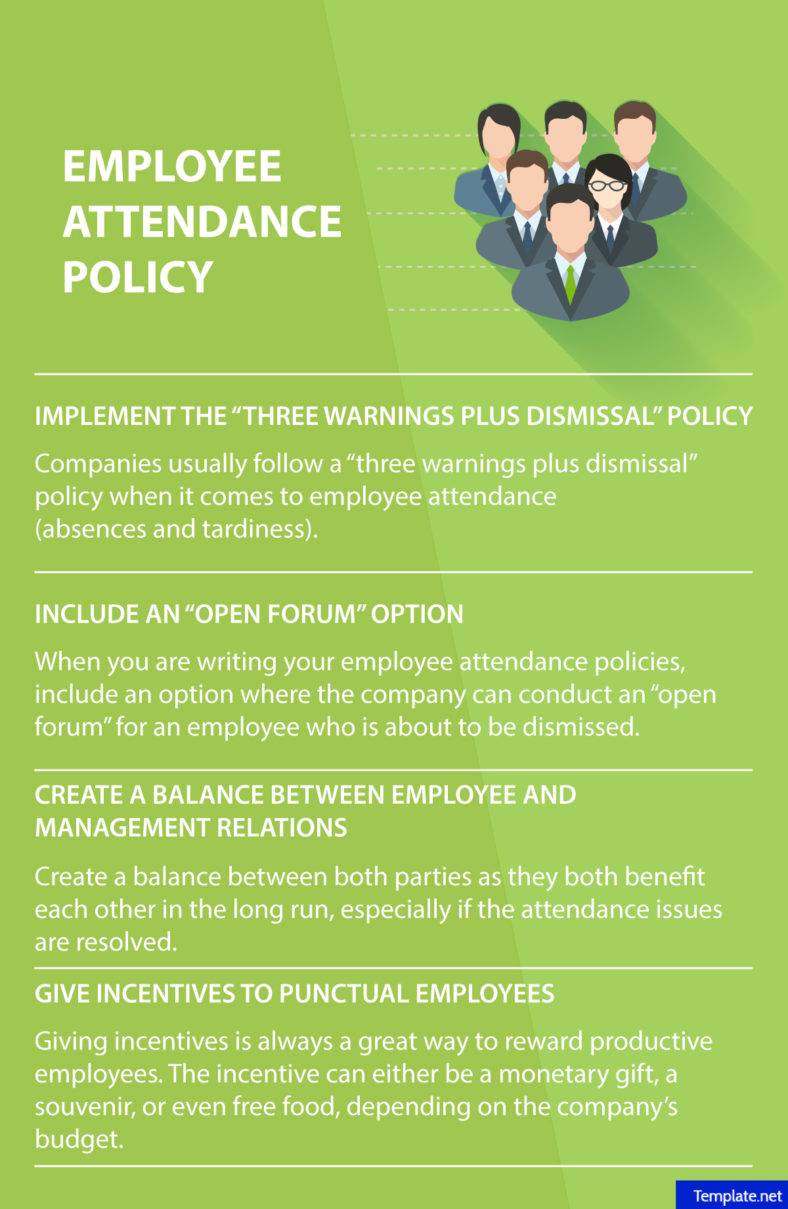

Best Employee Policies

Employees have access to their benefits during the entire period of their coverage. For example, they might use their health insurance for an annual physical. Discover the top 15 employee benefits software and platforms of Our comprehensive guide reviews the best solutions for streamlining HR processes. What are great employee benefits? · Paid leave · Affordable health insurance · A free weekday lunch · Digital coaching · Mental health prevention services · Gym. 10 fresh ideas for employee & company perks · 1. L&D budget · 2. Salary sacrifice scheme · 3. Mental wellbeing support · 4. Monthly lunches · 5. Free soft and. You're Protecting your Business · Maintain Productivity · Attract and Retain Top Talent · Provide Tax Efficient Compensation · Northern Financial Group Inc. Employees may become overly dependent on employer-provided benefits such as health insurance or retirement savings plans. This dependency can make it difficult. Promoting a healthy workforce: Many employee benefits support health and well-being. Access to medical care and wellness or enrichment programs helps employees. To write a good employee handbook, include a clear introduction and informative content covering all policies and procedures, ensure readability by using clear. 18 votes, 21 comments. The best I saw personally was: 4 weeks vacation first year Sabbatical after 4 years with 6 weeks paid 3 months remote. Employees have access to their benefits during the entire period of their coverage. For example, they might use their health insurance for an annual physical. Discover the top 15 employee benefits software and platforms of Our comprehensive guide reviews the best solutions for streamlining HR processes. What are great employee benefits? · Paid leave · Affordable health insurance · A free weekday lunch · Digital coaching · Mental health prevention services · Gym. 10 fresh ideas for employee & company perks · 1. L&D budget · 2. Salary sacrifice scheme · 3. Mental wellbeing support · 4. Monthly lunches · 5. Free soft and. You're Protecting your Business · Maintain Productivity · Attract and Retain Top Talent · Provide Tax Efficient Compensation · Northern Financial Group Inc. Employees may become overly dependent on employer-provided benefits such as health insurance or retirement savings plans. This dependency can make it difficult. Promoting a healthy workforce: Many employee benefits support health and well-being. Access to medical care and wellness or enrichment programs helps employees. To write a good employee handbook, include a clear introduction and informative content covering all policies and procedures, ensure readability by using clear. 18 votes, 21 comments. The best I saw personally was: 4 weeks vacation first year Sabbatical after 4 years with 6 weeks paid 3 months remote.

Benefits encourage employees to take care of themselves outside of the workplace, allowing them to bring their best selves to work. Health insurance, paid time. benefits. Understanding how the most common employee benefits work will help you choose the best options for your situation so you can gain the maximum. An array of attractive company benefits and perks like flexible work hours, comprehensive health coverage, and paid parental leave. If you are offering good benefits, this will help employees to stick around for the long run. It shows that you have their best interests in mind and that you. Unique job benefits that keep employees happy · 1. In-house professional development · 2. Massages and yoga · 3. Free books · 4. Daily pints of ice cream · 5. No. If you aim to enhance utilization and boost your company's reputation as a top employer in your industry, a top-notch benefits package is essential. 5 most valued employee benefits that your business should offer to unlock employee happiness & retention. Next to salary, having a good employee benefits plan is one of best ways to for you to attract and retain employees. Especially in sectors where there are. Employers who cannot offer good workers all the benefits they would like can sometimes find alternatives to the traditional employee benefit programs. Fringe. Some of the most popular non traditional benefits include, but aren't limited to, flexible working arrangements, learning and development, and better mental. Discover the top 15 employee benefits software and platforms of Our comprehensive guide reviews the best solutions for streamlining HR processes. What are the benefits of flexible work arrangements? Flexible work arrangements allow employees to balance their personal and professional responsibilities more. But just as success doesn't automatically happen in business – it takes dedication and hard work; putting together an equitable employee benefits package. Find out how you can meet employee demands, and what kind of benefits you should offer to improve employee engagement, retention and satisfaction in your. Discover how implementing a retirement plan can attract top talent and increase employee satisfaction in small businesses. Learn how employee health and. Alberta's Benefits Strategies shares the 10 most common types of employee benefits in Canada from health and dental to training expenses, etc. If you aim to enhance utilization and boost your company's reputation as a top employer in your industry, a top-notch benefits package is essential. We offer you and your loved ones a range of benefits to support your overall well-being: physical, mental, financial and work-life. A good benefits program helps you attract and keep the best employees, leads to happier and more productive workers, and ultimately can help your business. Employee Benefits Packages · Provide employees time off to vote, serve on a jury and perform military service · Comply with all workers' compensation requirements.

Pmi Renewal Fee

Once you've earned enough PDUs (60), you will get notified and asked to submit a renewal application and pay a renewal fee: $60 for PMI members. $ for non-. Time to complete the PDU; Level of effort it takes; Cost to earn this PDU. You'll be able to quickly see how to earn the maximum number of PDUs. PMP renewal fee is $ Same goes for RMP. Once you complete your PDU's your dashboard will have a Renew Now link. Click on that and it will take you to the. Low Cost, PMI Approved PMP Renewal PDUs. PDUnow is a PMI ATP. Earn PMP PDUs by paying one low fee starting at $ The renewal fee varies based on your PMI membership status and the renewal method you choose. You can pay the fee online through the PMI website. Membership Cost (US Prices plus G.S.T.) ; Professional, Student ; PMI annual membership dues. $ $ ; New member application fee. $ $ ; CWCC. Join PMI as a student member for $ All you need is your passion for project management and verification of college or university enrollment. Joining fee to become a PMI member is $ and $10 respectively. The membership fee is charged for a year and you can renew your membership for another year by. After you become a PMI member, you must renew it regularly. Therefore, you will pay the annual renewal fee, which is $ for PMI members. If your PMI. Once you've earned enough PDUs (60), you will get notified and asked to submit a renewal application and pay a renewal fee: $60 for PMI members. $ for non-. Time to complete the PDU; Level of effort it takes; Cost to earn this PDU. You'll be able to quickly see how to earn the maximum number of PDUs. PMP renewal fee is $ Same goes for RMP. Once you complete your PDU's your dashboard will have a Renew Now link. Click on that and it will take you to the. Low Cost, PMI Approved PMP Renewal PDUs. PDUnow is a PMI ATP. Earn PMP PDUs by paying one low fee starting at $ The renewal fee varies based on your PMI membership status and the renewal method you choose. You can pay the fee online through the PMI website. Membership Cost (US Prices plus G.S.T.) ; Professional, Student ; PMI annual membership dues. $ $ ; New member application fee. $ $ ; CWCC. Join PMI as a student member for $ All you need is your passion for project management and verification of college or university enrollment. Joining fee to become a PMI member is $ and $10 respectively. The membership fee is charged for a year and you can renew your membership for another year by. After you become a PMI member, you must renew it regularly. Therefore, you will pay the annual renewal fee, which is $ for PMI members. If your PMI.

renewal after paying PMP certification renewal fee. Overview. Starting The After this, you will be required to reaffirm the code of ethics stipulated by PMI. As per PMI, the renewal cost for PMI members is about 48 GBP, while for non-members, it is GBP. Certified professionals must acquire 31 Professional. Pay the renewal fee ($60 for PMI members and $ for non-members). After successfully paying the fee, your certification is renewed. These steps will help. Renew or Transfer Membership · If the expiration period is less than 1 year, you will have to renew your membership from the expiration date · If the expiration. If you're among PMI members, you'll get a discount and pay a fee of only $ However, if you aren't, you'll pay $ If you've passed the 60 PDU mark, you don. However, PMI membership costs $/year, so practically a PMI membership won't help you save much if you're thinking about becoming a member just to renew your. The renewal fee is $90 for one certification, $ for two, $ for three, $ for four, $ for five (per person). Renew Now · ceu icon. CEU Tracker. Every three years, applicants need to renew their ACP Certificate by paying renewal fees and earning PDU. The renewal fees vary for PMI members and non-members. After one year, you must pay USD to renew your membership. #2. Student Membership. This membership is for students. The annual membership fee is USD You. Reason 1: Minimize PMP® Exam fee Costs · PMI® Membership in U.S.A: Fee increase by $10 (from $ to $). · PMP® Exam for Members in U.S.A: Fee increase by $ The fee for PMI Individual Membership will increase by US$10 and will now be US$, plus a one-time US$10 application fee for first-time members. As a member, you get exclusive savings on PMI certification exam and renewal fees, exclusive discounts on PMI courses, events and webinars, no-cost access. The fee to renew your certification is $60 for PMI members and $ for nonmembers. The PMI membership fee is $ per year for most people. Those without an active PMI membership must pay $ to renew their PMP certification. Examination Fees. Regardless of the preparation method, there's an. Membership to PMI International costs $ USD (+ $10 USD for administrative fees You will receive an instant notification from PMI on the status of your. If you are a PMI member – meaning you have an active, paid membership with PMI (typically costing $ USD annually) – the PMP renewal fee is $ For non-PMI. The annual renewal fee is due by the end of the month in which you joined. The global PMI renewal is $ and chapter WMPMI renewal is $ You must. The membership fee of PMI for new members is about USD with an The membership renewal fee is about USD. These PMI membership amounts. The Project Management Institute (PMI) membership cost varies depending on the region and membership type. The annual membership fee for PMI professional. renewal after paying PMP certification renewal fee. Overview. Starting The After this, you will be required to reaffirm the code of ethics stipulated by PMI.

Best Rental Property Insurance In Florida

An Allstate landlord insurance policy helps protect you, your property and your investment. Talk to an agent to learn more. Do you own any rental properties in Florida? If so, make sure you have sufficient landlord insurance coverage. Blue Sky Insurance® works with several property. We compiled this list of the top insurance companies for Florida landlords. This guide can help you understand your choices and access the coverage you need. When it comes to your Florida rental property, trust the best. Traditional homeowners insurance won't cover a rental, so you'll need landlord insurance to. For landlords who own rent to tenants, check out Farmers Insurance landlord insurance policies. For renters, explore our rental property insurance policies. Rental property insurance is available for single-family residential rentals as well as rental properties with one to four units, excluding condominiums – for. Olympus Insurance offers a comprehensive Florida Rental Property insurance policy (also known as Florida Landlord Insurance or Dwelling Fire Insurance. Steadily offers comprehensive landlord insurance designed to meet the needs of rental property owners and investors across Florida. Committed to efficiency. Based on our analysis, Stillwater, Tower Hill, Castle Key (an Allstate company), and American Traditions have some of the cheapest landlord insurance in Florida. An Allstate landlord insurance policy helps protect you, your property and your investment. Talk to an agent to learn more. Do you own any rental properties in Florida? If so, make sure you have sufficient landlord insurance coverage. Blue Sky Insurance® works with several property. We compiled this list of the top insurance companies for Florida landlords. This guide can help you understand your choices and access the coverage you need. When it comes to your Florida rental property, trust the best. Traditional homeowners insurance won't cover a rental, so you'll need landlord insurance to. For landlords who own rent to tenants, check out Farmers Insurance landlord insurance policies. For renters, explore our rental property insurance policies. Rental property insurance is available for single-family residential rentals as well as rental properties with one to four units, excluding condominiums – for. Olympus Insurance offers a comprehensive Florida Rental Property insurance policy (also known as Florida Landlord Insurance or Dwelling Fire Insurance. Steadily offers comprehensive landlord insurance designed to meet the needs of rental property owners and investors across Florida. Committed to efficiency. Based on our analysis, Stillwater, Tower Hill, Castle Key (an Allstate company), and American Traditions have some of the cheapest landlord insurance in Florida.

When it comes to your Florida rental property, trust the best. Traditional homeowners insurance won't cover a rental, so you'll need landlord insurance to. Bellken Insurance Advisors has made a name for itself as one of Florida's top real estate investor insurance providers. For tenants renting apartments, condos, or homes, the best renters insurance in Florida is always a policy with customized coverage limits. Here are some extra. A DP-3 policy is considered the best type of protection for residential homes rented to others, homes with older roofs, or investment properties. We offer a variety of flexible coverage options to ensure you're fully covered. Your Agent can customize a policy to fit your unique needs and budget. An Allstate landlord insurance policy helps protect you, your property and your investment. Talk to an agent to learn more. Bellken Insurance Advisors has made a name for itself as one of Florida's top real estate investor insurance providers. No, it is not legally required to have renters insurance in Florida. However, landlords may require tenants to have renters insurance as a condition of the. In contrast, InsuraGuest was born straight out of the vacation rental insurance industry and is focused only on vacation rental property insurance. We know. Best Overall: State Farm · Runner-Up, Best Overall: Liberty Mutual · Best for Bundling Policies: Allstate · Best for Multi-Unit Properties: Farmers · Best for. Whether you own multiple rental properties or need to sublet your home for a year while you travel for business, we can help. The GEICO Insurance Agency can. Our company has insured Florida property owners since We have a team of Licensed Agents who make it top priority to get people the right coverage for. As more insurers exit from Florida and hurricane coverage is getting harder to find, Proper Insurance remains the top insurer of short-term rentals in Florida. A Dwelling Fire Landlord policy (or DF3-DL) is an 'a la carte' insurance policy. It offers flexible coverage options to owners of rental properties. USAA Rental Property Insurance helps cover homes you own and rent to others. If you're PCSing or buying something new, we can easily change your. Our company has insured Florida property owners since We have a team of Licensed Agents who make it top priority to get people the right coverage for. Florida rental property insurance also often called landlord insurance provides coverage that protects your investment. A good policy, in addition to covering. With a score of 4 out of 5, State Farm is the best homeowners insurance company in Florida according to our research. AirBnB; HomeAway; EasyRoommate; VRBO; Home Exchange; Hometogo. You need a specialized form of insurance policy called Landlord Protection Insurance, also known.